What Is Cash flow?

The vitality of any firm, regardless of size, is cash flow. In a nutshell, cash flow is the flow of funds into and out of your company over a given time frame. It’s a vital financial indicator showing how effectively your company collects and allocates cash to payments for ongoing operations, capital projects, and prospects.

Whether you’re a finance professional or an entrepreneur running a startup, knowing your cash flow is critical to making wise decisions that maintain your company’s health and viability.

Hence, it is necessary to integrate with the best finance management platform to gain insights into cash flow and its necessity.

In this article, we’ll explain cash flow, its types, and how to manage it well to protect your company’s finances.

Cash Flow Statement

The cash flow statement is a fundamental financial statement detailing a business’s money source and usage over a period. It is also used to assess cash flows. This statement shows how well a company makes enough money to pay off debt and control its operations costs.

Analysts, corporate leaders, and investors use it. Alongside the balance sheet and income statement, an organization also issues the cash flow statement, which is an essential financial record.

Please download the Free Cash Flow Statement Template Here

How Is Cash Flow Analyzed?

The following actions are suggested to guarantee that a company has an ideal cash flow:

- Ensure that all monetary transactions are entered into your bookkeeping records promptly.

- Through quarterly cash flow statement preparations, businesses can maintain the tracking and analysis of cash inflow and outflow from various sources.

- By analyzing the statement, determine whether to add more money to the company or release some cash.

- To improve cash flow into a business, pinpoint areas where overspending occurs and reduce those expenses.

- Other steps might be taken in addition to these To maximize an entity’s cash flow.

Please read our blog on Profit vs. Cash Flow

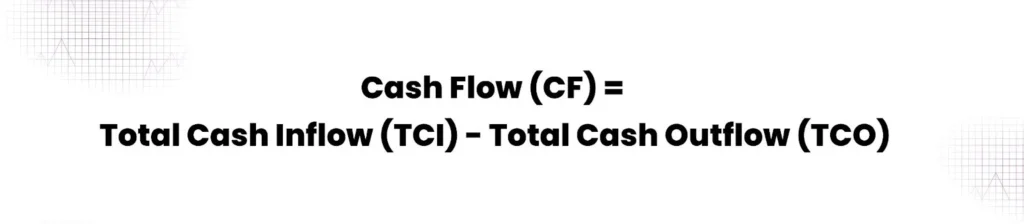

Cash Flow Formula and Calculation

A simplistic way to calculate cash flow is the following formula, you can quickly determine a business’s cash flow. Make sure you find the total cash input and outflow before doing this.

This is called the direct method and suffers from the following disadvantages

- Limited Insight: This doesn’t show profitability or changes in working capital, limiting financial analysis.It may not highlight long-term trends in profitability or the financial impact of accruals and non-cash transactions. E.g. If the cash collected was for the previous month, looking at it may lead to erroneous analysis

- Reconciliation Needed: Often requires additional reconciliation to net income.

- Error-Prone: High risk of oversight with complex, high-volume transactions.

The more popular method of understanding cash flow is the indirect cash flow method. The below paragraph provides an outline of this method.

Cash Flow Types

1. Operating Cash Flows

Fund flows directly related to the production and sale of items from routine activities are referred to as cash flow from operations or CFO. CFO, sometimes referred to as operating cash flow, shows whether a business has enough revenue to cover its operating costs and obligations.

2. Investing Cash Flow

The cash flow from investing (CFI), sometimes referred to as investing cash flow, is a statement of the total amount of money earned or expended on different investments over a specific period of time.

3. Financing Cash Flows

Cash flows from financing, or CFF, represent the net cash flows utilized for funding the business and its capital. Another frequently used name for CFI is financing cash flow. Finance-related transactions include things like issuing debt, shares, and paying dividends.

Owners can gain more insight into the capital structure of a business’s management abilities and its financial wellness by examining the cash flow produced by financing activities.

Also read: 6 rules for managing small business cash flow!

Final Words

Any business depends on its cash flow to maintain operations and represent its financial health. Analyzing a company’s success requires understanding the three cash flow types: operating, investment, and financing. Businesses can ensure security and development by making educated financial choices and tracking cash flow through comprehensive reporting.

When efficiently managing cash flow, Paci.ai might be your ideal accounting partner. With our knowledgeable support and advice, you can preserve financial stability and prosper in cutthroat marketplaces.

Connect with us for more insights and understanding about cash flow management.