“Revenue is Vanity, Profit is Sanity, but Cash is King. This is a proverb that resonates through the corridors of startups and multinationals alike in the fast-paced world of business. This is where every penny counts, and every choice can change the course of success. This famous proverb distills the essence of financial wisdom and acts as a beacon of guidance for business leaders and entrepreneurs looking for better financial management.

But what’s really behind this catchy phrase?

Fundamentally, it emphasizes how crucial it is to comprehend the gap between profit and cash flow, as this may make or break a company. Although profit, which is sometimes seen as the measure of success, provides information about a company’s financial health on paper, cash flow is actually what powers daily operations and long-term expansion.

However, why does this distinction matter, and how does it shape the path to sustainable growth and stability?

Let’s get into how a better understanding of profit and cash flow might revolutionize your company’s financial strategy.

The Significance of Distinguishing Cash Flow from Profit

Profit is the best measure of a company’s performance. It narrates a tale of monetary gain, with earnings exceeding costs. Even still, without taking into account cash flow—the vitality that powers daily operations, motivates investments, and ensures financial stability—this story falls short, despite its appealing nature.

Beyond simple accounting semantics, the distinction between profit and cash flow is essential to sound financial management. Gaining an understanding of this distinction is similar to learning the art of economic balance, which guarantees that a company may prosper today while making strategic plans for the future.

What Is Profit?

Profit, also called net income, is the surplus or leftover after all expenses are deducted from sales revenue. Revenue does not mean that there will be profit; it can be a loss, too, and that is why it is called vanity.

Net profit, which is essential for a business to generate cash to distribute returns to shareholders, repay loans, and reinvest to survive and grow, is the basis on which tax is computed (will come into play in UAE once corporate taxation kicks in post-June 2023. There are three significant types of profit that companies report on profit and loss or income statement:

- Gross profit – the amount of profit that remains after subtracting the expenses incurred in producing and marketing its goods (cost of goods sold – COGS) or the costs associated with providing its services (cost of sales – COS)

- Operating profit and EBITDA – total earnings from its core business functions for a given period, excluding non-operating income like interest earned and the deduction of interest and taxes. EBITDA differs in that amortization and depreciation of capital investments are deducted from operating profit, making it much closer to cash flow.

- Net profit – the final profit, after considering all income – operating and non-operating and all business expenses – operating, non-operating, and non-cash.

Each type of profit gives the readers of the profit and loss statement an insight into the company \’s performance, especially when compared to previous periods, peers, and industry benchmarks. The analysis of each type of profit guides businesses in making informed business decisions.

For example, gross profit tells you how much it will cost you to make the product ready for sale, and net profit gives you a view of what is left for profit distribution, how much can be reserved for future needs, and the amount that can be reinvested for diversification or expansion. That said, these are possible only if cash is available.

What Is Cash Flow?

The inflow and outflow of money in a business throughout the business cycle is called Cash Flow. It takes the form of a collection of invoices, payments to vendors, taxes, employee salaries, and other operating costs.

In other words, it excludes all accruals, provisions, and non-cash expenses like depreciation and amortization.

- Positive cash flow enables organizations to settle debts, reinvest in their business, distribute profit and return money to shareholders, and maintain a reserve against future financial contingencies.

- Negative cash flow indicates that a company will find it difficult to meet its liabilities on time and will not be able to grow the business.

The statement of cash flows may include three different types of cash flow, depending on the activity’s scope: financing, investing, or operating activities.

- Operating activities include cash movements related to the operating activities like cash collected from the revenue generated, and cash paid to vendors against the supply of goods and services required for the operations.

- Investing activities comprise cash activities related to noncurrent assets like investments in capital assets, long-term investments, loans made to other entities, and cash received from the sale of land, but not the interest received from loans.

- Financing activities include the movement of money related to noncurrent liabilities and owners’ equity like the amount of long-term loan received, cash received against the sale of equity stock or cash paid to repurchase equity or repurchase of equity stock, payment of dividends, but not the interest paid on long-term loan.

The Cash Flow Formula

The formula for calculating cash flow is straightforward yet revealing: Cash Flow = Cash from Operating Activities +(-) Cash from Investing Activities +(-) Cash from Financing Activities.

This formula encapsulates the total picture of how cash moves through a business, highlighting the importance of not just earning revenue but managing investments and financing activities effectively.

What is the Difference Between Cash Flow and Profit?

Cash flow is the actual money coming into and going out of your business; the difference between them is the cash position—positive or negative.

Profit is what remains from sales revenue billed and recognized. It is collected after meeting all the business expenses incurred, though not paid. When you raise an invoice, you recognize it as revenue, subject to the provisions in the applicable accounting standard. In accounting, profit is reported in the profit and loss statement but reported in cash flow only when the money is collected from the customer against the invoice.

Likewise, when you receive goods or services from vendors, you book their invoices as expenses or inventory, but cash flow will be affected only when you pay those bills. Similarly, investments in noncurrent assets will appear in cash flow when it is paid. In contrast, only the portion of depreciation relevant to the period will come in the income statement.

Even if a company is profitable, its cash flow may still be insufficient. Likewise, even with solid cash flow, a company may fail to turn a profit.

For example, if a profit-making company invests in capital or growth projects, cash flow can become tight or negative, requiring external funding. Cash flow and profit are necessary for businesses to survive and expand over time.

How Do Cash Flow and Profit Interact?

As discussed, being profitable does not necessarily mean your cash flow is in a better position, or having positive cash flow does not mean that your business is profitable.

For cash flow, cash-to-cash cycle time (also known as a cash conversion cycle or order-to-pay cycle) that evaluates the days between buying materials/inventory from suppliers and collecting payment from customers is important.

If your customer delays payment of your invoices by 60 days after the credit days, you may still make a profit, but it will affect your ability to pay your suppliers, meet payroll, and pay other business expenses, impacting your business operations.

Likewise, suppose you make a capital investment in equipment or other assets to diversify or expand. In that case, the cash goes out initially and is reflected in the investing part of the cash flow.

However, due to statutory and tax provisions, the income statement does not show the entire upfront investment, only the depreciation for the reporting period.

Profit vs Cash Flow – Which Is More Important to a Business?

The answer to that question depends on the type of business and the situation. Cash flow needs more focus to run the business. This is when a company generates profits consistently but has no cash to pay vendors and employees. This is because its cash is held up in receivables and other assets. If the business is neither profitable nor has a cash surplus from operating cash flow, the focus has to be on making a profit.

Unless you make a profit, there won’t be any cash from operations; a loan fund is a liability. The lack of profit finally has a drop in cash flow. While profit is a better measurement of the success of your business, cash flow is indispensable for running the business. In the long term, the absence of profit impacts cash flow.

Business owners and leaders should have sufficient knowledge of the difference between profit and cash for better decision-making.

However, most small businesses may not have the competence to handle the situation. This is where a SaaS application that is both accounting and finance at an affordable subscription rate, without the need to invest upfront, can help you. These tools work for you as an accountant and financial analyst or even a CFO who can give you all the economic insights that you need to manage and scale your business.

Why is Cash Flow More Important Than Profit?

In the world of business, profit is frequently the focus of attention, and many people associate profitability with success. However, when one looks more closely at the financial nuances of managing a company, one finds a different hero: cash flow. However, why is cash flow valued higher than profit? Let’s look at several examples that highlight how crucial cash flow is compared to simple profitability.

Consider a company that, at least on paper, looks lucrative, with strong margins and significant revenue growth. Under the surface, though, it struggles to pay for salaries and other regular obligations like supplier payments. This contradiction occurs when recorded profits are linked to unpaid bills or inventory left on the shelf—assets that are not easily exchanged for cash to settle debts. A situation like this emphasizes the meaning of the proverb, “Cash is king.”

A tech startup, for example, might land a big contract and anticipate big profits. But if the terms of payment are spread out over several months, and the business’s operating costs don’t change, it may struggle to maintain operations even though it is “profitable.” Companies may find themselves in a situation known as a “liquidity trap” when they have long-term profitability but are unable to pay their short-term debts due to this disparity between profit and cash flow.

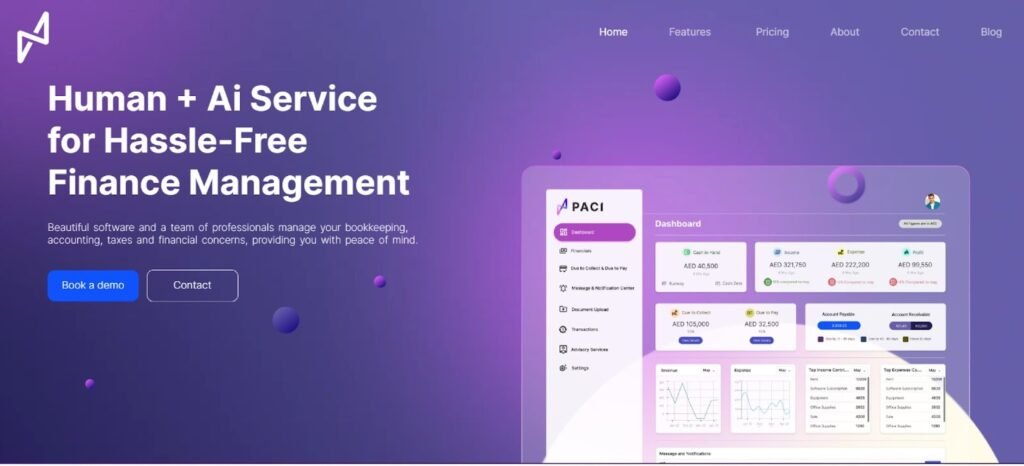

This is the point at which cash flow management becomes crucial. Having a solid understanding of and emphasis on cash flow management is made possible by cutting-edge technologies like Paci.ai. It enables organizations to flourish rather than just survive, proving that cash flow is, in fact, more important than profit for a company’s long-term viability.

How Does Paci.ai Help in Financial Management?

Businesses frequently face difficult obstacles on their path to financial mastery. This includes figuring out how to interpret the minute distinctions between operational profit and cash flow or navigating the complexities of cash flow statements. Here’s where Paci.ai emerges as a cutting-edge application. Paci.ai provides a smooth solution for hassle-free financial management with a well-balanced combination of human competence and AI technology. Businesses may overcome the challenges of traditional financial management using Paci.ai, obtaining clear insights and practical tactics to improve their financial decision-making.

In addition to being a tool, Paci.ai is a partner that helps companies understand their finances so they may concentrate on expansion without sacrificing their financial stability. When it comes to elucidating the “cash flow formula” or explaining “why cash flow is more important than profit,” Paci.ai is prepared to illuminate the route to monetary success and clarity.

Final Words

Through our exploration of the profit and cash flow financial landscapes, we have discovered the real meaning of the proverb, “Revenue is Vanity, Profit is Sanity, but Cash is King.”

Comprehending the distinction between profit and cash flow is advantageous and crucial to the well-being and prosperity of any enterprise. Profit reveals the potential, but cash flow keeps the company running daily.

Paci.ai provides a smooth solution for individuals wishing to travel through these waters with ease. Its integration of AI technology and human knowledge makes efficient financial management more than just a dream. Reach out to us today and take the first step towards financial clarity and peace of mind.