The capacity of any small business to expand and prosper rests on its ability to manage cash flow successfully. Maintaining the financial stability of your company means keeping an eye on, evaluating, and managing the money coming in and going out.

However, numerous small businesses find cash flow management challenging due to various issues, such as unpredictable spending and inconsistent revenue streams. Therefore, hiring an established accounting company to handle your cash flow management would be ideal.

Small companies face the following difficulties in cash flow management:

- Variations in Income

- Trends by Season

- Poor Planning

- Unexpected Expenses

Thus, you must know these 6 rules for managing your cash flow before you start to work on your cash flow system.

So, let’s start to explore the six rules for cash flow management!

6 Rules for Small Business Cash Flow Management

1. Regular Cash Flow Monitoring

Maintaining the financial viability of your small business depends on routinely reviewing your cash flow. It provides you with knowledge about the financial situation of your business, empowering you to plan ahead and make informed choices.

Regular monitoring also makes it feasible for you to identify potential cash flow issues earlier and then take the necessary measures. You can improve your cash flow management using predictive tools and real-time data provided by an integrated platform.

Regular cash flow monitoring helps in the following:

- Transparency

- Prior Alert

- Decision Making

- Planning

2. Review and Adjust Cash Flow Strategies

By examining and modifying your cash flow approaches, you may optimize your financial performance. You can identify areas where you can reduce costs, increase revenue, and improve your income streams by routinely reviewing your cash flow.

This plan helps you make informed decisions that drive the growth and success of your business.

Reviewing and adjusting cash flow strategies helps in the following:

- Keep Ahead of Financial Problems

- Enhance Financial Results

- Adjust to Changing Market Situations

3. Simple Accounting

Most small businesses end up complicating their accounting system without any reason. This is why having a good accountant and accounting software in place is necessary.

For example, your accounts will give you an idea of how prepared you are to handle a large new order that is coming up. You may monitor several accounting KPIs, like inventory turnover, operating margins, and accounts receivable aging, with the use of good accounting software.

Simple accounting helps in:

- Organized Financial Data

- Automated Processes

- Financial Security

- Real-Time Insights

4. Separate Personal and Business Finances

Another accounting rule every small business owner must follow is to understand their cash flow and forecast how it might change over some time.

Most business owners tend to complicate things by mixing up their financial and personal finances. This is why you must keep both personal and business finance separate.

Separating personal and business finances helps in:

- Legal Protection

- Tax Compliance

- Financial Clarity

- Professionalism

5. Build a Solid Cash Reserve

Having a cash reserve is another fundamental accounting rule every small business owner must take care of. A cash reserve provides the cushion you need to manage any unexpected events.

This can insulate you from the economic cycle of your business. In simple words, a cash reserve puts your business in a position of strength.

A solid cash reserve helps in:

- Financial Stability

- Emergency Fund

- Strategic Opportunities

- Peace of Mind

6. Seek Professional Advice

There are numerous methods you can employ to increase cash flow. However, consulting with financial professionals can offer priceless insights and direction.

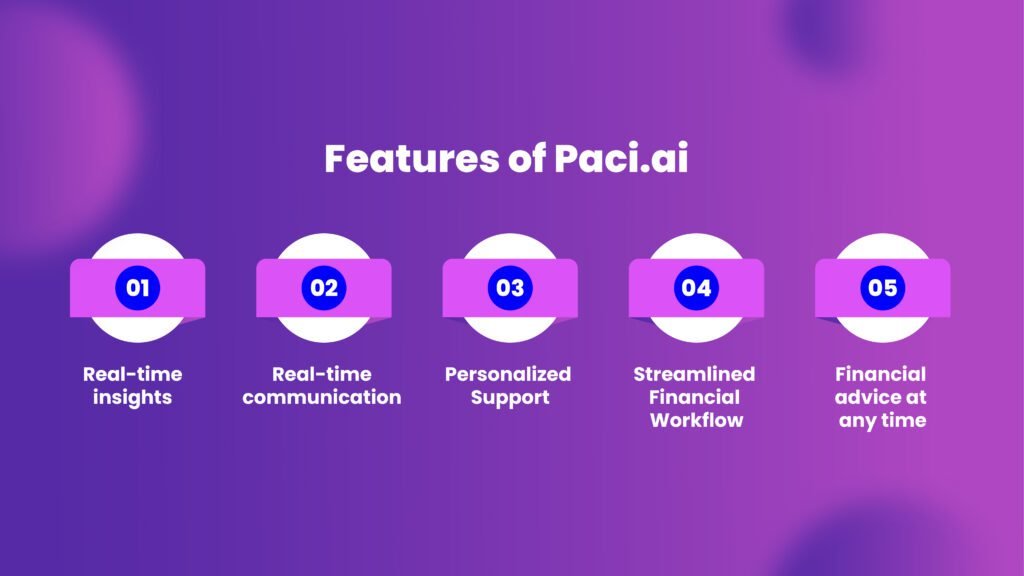

At Paci.ai, we understand the importance of professional advice while handling your cash flow. Our team of professionals is dedicated to helping you navigate the difficulties of money management and developing strategies to improve cash flow.

You may get professional advice and guidance to help you succeed financially with an integrated accounting service.

Our Services include:

- Real-time financial dashboard

- Real-time communication channel

- Bookkeeping and tax suite

- Customized insights and financial advisory

- Seamless receivables and payable management

- Easy transaction management

Seeking professional advice helps in the following:

- Expertise

- Tailored Solutions

- Strategic Planning

- Compliance

Final Thoughts

To sum up, cash flow management is essential to any small business’ success. You may safeguard the long-term viability of your company and enhance your financial situation by putting the six guidelines stated by Paci.ai into practice.

These rules can have a significant impact on the financial health of your company, from routine cash flow monitoring to expert assistance. See the benefits these tactics can have on your cash flow management by putting them into practice right now.

If you are still unsure how to effectively manage your cash flow, get an integrated accounting platform on your side.

Connect with us for more information on cash flow management for small businesses.