P&L template

A profit and loss statement is a major element in any business that shows its financial health.

A profit and loss template, or P&L template, shows your business’s revenue against expenditures, which aids in determining profit.

P&L templates may be used to examine and compare a company’s performance over a particular period of time. This is in addition to being useful tools for reviewing cash flow and forecasting potential company success.

The formula for profit and loss statement is:

Net Income = Total Revenues – Total Expenses

P&L Template in Excel

You can get the P&L templates over time, like monthly, quarterly, or yearly.

Here, in this article, we will show you the P&L templates for quarterly and yearly.

First, we will show you a simple format for a profit and loss statement template.

| Profit and Loss Template | |||

| Company Name | Statement Reporting Period | ||

| Your company name | dd/mm/yy – dd/mm/yy | ||

| Revenue (deduction for returns and discounts) | Expenses | ||

| Sales Revenue | $642,754 | Wages and Benefits | $287000 |

| Other Revenue | $37, 765 | Internet and Phone | $6500 |

| Gross Revenue | 680519 | Utilities | $10900 |

| Office supplies | $2650 | ||

| Rent/Mortgage | $21100 | ||

| Cost of Goods Sold (COGS) | Insurance | $2800 | |

| COGS | $84600 | Interest | $1800 |

| Total COGS | $84600 | Depreciation | $4950 |

| Taxes | $17800 | ||

| Travel | $3000 | ||

| Gross Profit | Other Expenses | $25000 | |

| Gross Profit = Gross Revenue – COGS | $595919 | Total Expenses | $383500 |

| Net Income | |||

| Gross Profit – Total Expenses | $212419 | ||

Quarterly Profit and Loss Template

| Quarterly Profit and Loss Template | ||||

| Company Name | ||||

| Revenue | Q1 | Q2 | Q3 | Q4 |

| Sales Revenue | $650975 | $689245 | $605425 | $732178 |

| Service Revenue | $52856 | $88924 | $52645 | $65327 |

| Interest Revenue | $37698 | $79800 | $62650 | $40750 |

| Others | $15876 | $29542 | $27850 | $19874 |

| Total | $757405 | $887511 | $748570 | $858129 |

| Less Sales Returns/Allowances | $20200 | $23650 | $27900 | $18540 |

| Total Revenue | $737205 | $863861 | $720670 | $839589 |

| Expenses | Q1 | Q2 | Q3 | Q4 |

| Expense 1 | $26800 | $37632 | $32540 | $74327 |

| Expense 2 | $65429 | $53297 | $57327 | $71100 |

| Expense 3 | $62200 | $51265 | $37511 | $42600 |

| Expense 4 | $51500 | $55789 | $47923 | $39875 |

| Expense 5 | $53875 | $37837 | $46245 | $81200 |

| Total Expenses | $259804 | $235820 | $221546 | $309102 |

| Net Income Before Taxes | $497601 | $651691 | $527024 | $549027 |

| Tax Rate (%) | 7.25 | 7.25 | 7.25 | 7.25 |

| Income Tax Expense | $36076 | $47248 | $38209 | $39804 |

| Net Income | $461525 | $604443 | 488815 | 509223 |

Annual Profit and Loss Template

Annual Profit and Loss Template | ||||

Company – Jack’s Cafe | Statement Reporting Period | |||

Revenue | 2020 | 2021 | 2022 | 2023 |

Gross Sales ($) | 20190 | 57440 | 86325 | 11265 |

Less Sales Return and Allowances ($) | – | – | – | – |

Net Sales ($) | 20190 | 57440 | 86325 | 11265 |

Cost of Sales | ||||

Beginning Inventory ($) | 200 | 210 | 220 | 230 |

Plus Goods Purchased/Manufactured ($) | 120 | 150 | 160 | 190 |

Total Goods Available ($) | 320 | 360 | 380 | 410 |

Less Ending Inventory ($) | 200 | 230 | 240 | 260 |

Total COGS ($) | 100 | 130 | 160 | 170 |

Gross Profit (Loss) ($) | 20090 | 57310 | 86165 | 11095 |

Operating Expenses | ||||

Selling | ||||

Salaries and Wages ($) | 650 | 700 | 750 | 800 |

Commissions ($) | 10 | 11.13 | 14.75 | 15 |

Advertising ($) | 525 | 560 | 647 | 720 |

Depreciation ($) | 20 | 25 | 29 | 35 |

Others ($) | – | – | – | – |

Total selling Expenses | 1205 | 1296.13 | 1440.75 | 1570 |

General | ||||

Employee Benefits ($) | 4 | 4.12 | 4.13 | 4.15 |

Payroll Taxes ($) | 2 | 3 | 3 | 4 |

Insurance ($) | 450 | 470 | 500 | 560 |

Total General Expenses ($) | 456 | 477.12 | 507.13 | 568.15 |

Total Operating Expenses ($) | 1661 | 1773.25 | 1947.88 | 2138.15 |

Net Income Before Taxes ($) | 18429 | 55536.75 | 84217.12 | 8956.85 |

Taxes on Income ($) | 3562 | 5425 | 7654 | 7721 |

Net Income After Taxes ($) | 14867 | 50111.75 | 76563.12 | 1235.85 |

Extraordinary Gain/Loss ($) | 19 | – | 20 | – |

Income Tax on Extraordinary Gain | 4 | – | 3 | – |

Net Income ($) | 14890 | 50111.75 | 76586 | 1235.85 |

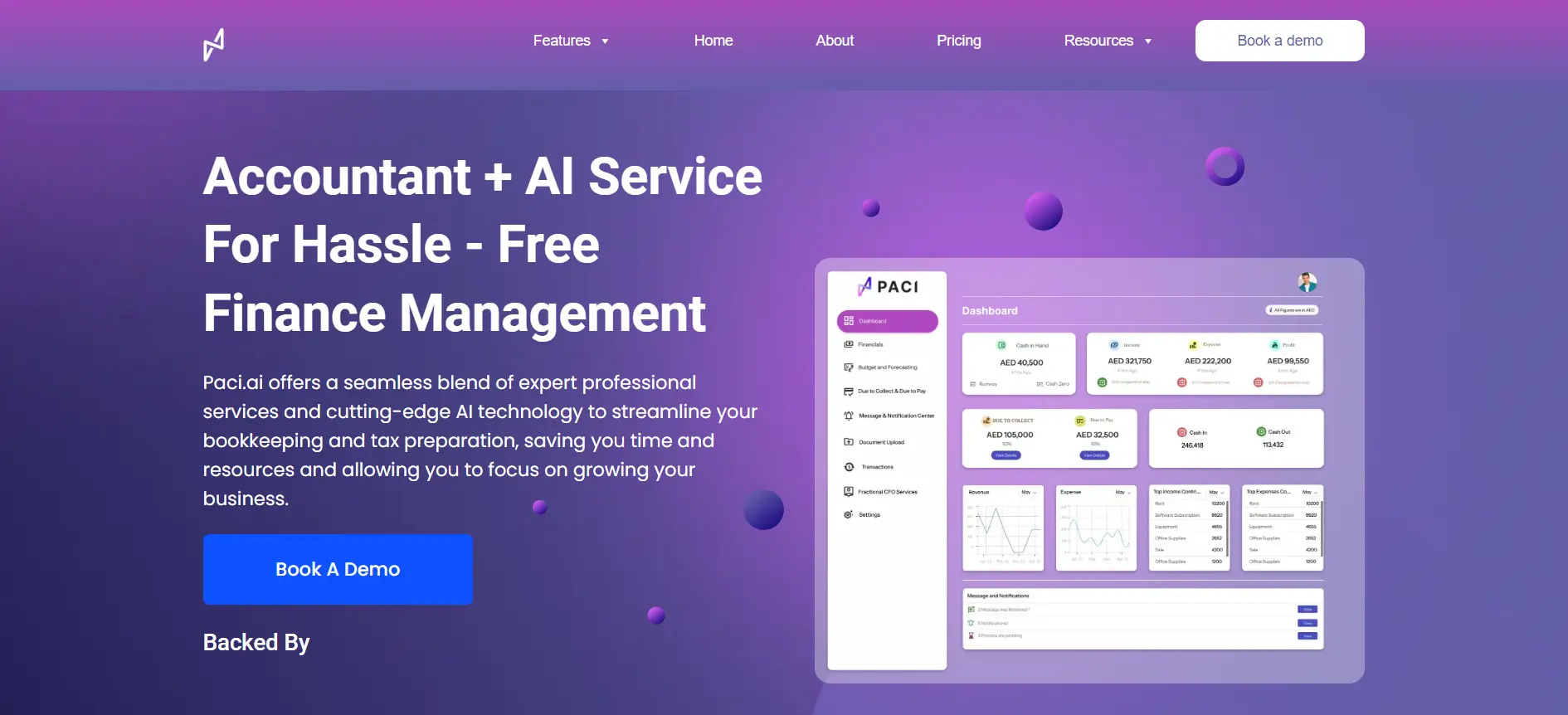

How Paci.ai Helps in Finance Management

Paci.ai is an integrated finance management platform that assists you with all your financial concerns. Paci has an account manager who handles all your accounts with the utmost accuracy and precision.

You can operate your company, evaluate your results, and make the best data-driven decisions using Paci.ai.

In addition to organizing your financial records and helping to categorize your expenses, your bookkeeper comes to understand your company.

You can manage your money using real-time balance sheets, P&L statements, cash flow, and tax compliance reports.

Our services are:

- Real-Time Financial Insights Dashboard

- Seamless Receivable and Payable Management

- Real-Time Communication Channels

So, what are you looking for?

Connect with us right now to get your format for profit and loss statement, so that you can be confident about the right financial management.