Easy To Use Expense Report Template For Small Businesses

Imagine managing your company if you have yet to learn where your money is spend.

This is where an expense report comes in handy. It’s essential for keeping track of every penny you spend, managing your expenses, and ensuring nothing is lost.

An expense report helps you monitor your spending and clearly see your financial situation, regardless of whether you’re spending on travel, office supplies, or client meetings.

This is important for small businesses. An accurate expense report facilitates cash flow optimization, cost control, and tax preparation—essential activities that directly affect your bottom line.

Controlling costs has been simple for businesses because of services like an integrated finance management platform, which automates and streamlines the entire process.

So, let us discuss what an expense report is and its importance.

What is an Expense Report and Why Does Your Small Business Need One?

An expense report is a comprehensive document that lists all of the costs that a firm’s owners or workers have incurred within a given time period.

It usually covers expenses such as transportation, food, office supplies, and any other related to operating the company.

The main goal of an expense report is to give a precise and well-organized summary of company spending. This aids in tracking costs for tax, payment, and budgetary purposes.

Expense reports provide small businesses with vital information about how money is spent, enabling you to make wise financial decisions.

By keeping precise expenditure reports, you can minimize wasteful spending, monitor cash flow, and guarantee tax compliance.

How Expense Reports Help Monitor and Manage Business Expenses:

- Better Budget Management: By breaking down each item, companies can find areas where expenses exceed anticipated by comparing actual spending to the budget.

- Expense Accountability: Employees and business owners can keep within spending restrictions by knowing where every dollar is going.

- Tax Efficiency: Well-organized expense reports make it easier to file taxes by making sure that all allowable costs are monitored and reported.

- Improved Cash Flow: By tracking expenses on time, companies can better manage their cash flow and prevent financial shortages.

- Data-Driven Decisions: Small businesses can make more informed choices about resource reallocation or cost reduction by comprehensively understanding their expenses.

Why Traditional Expense Reporting Can Be Challenging

Handling expense reports by hand is frequently ineffective, prone to mistakes, and a productivity drain. The difficulties associated with traditional expense monitoring techniques can hurt business performance and financial correctness. The following are the primary challenges:

- Manual Entry Issues

- Time-Consuming Process

- Lack of Real-Time Data

Key Features of an Easy-to-Use Expense Report Template

- Simple Interface and Customization

- Automated Calculations

- Clear division of expenses into relevant categories

- Receipt Attachment Options

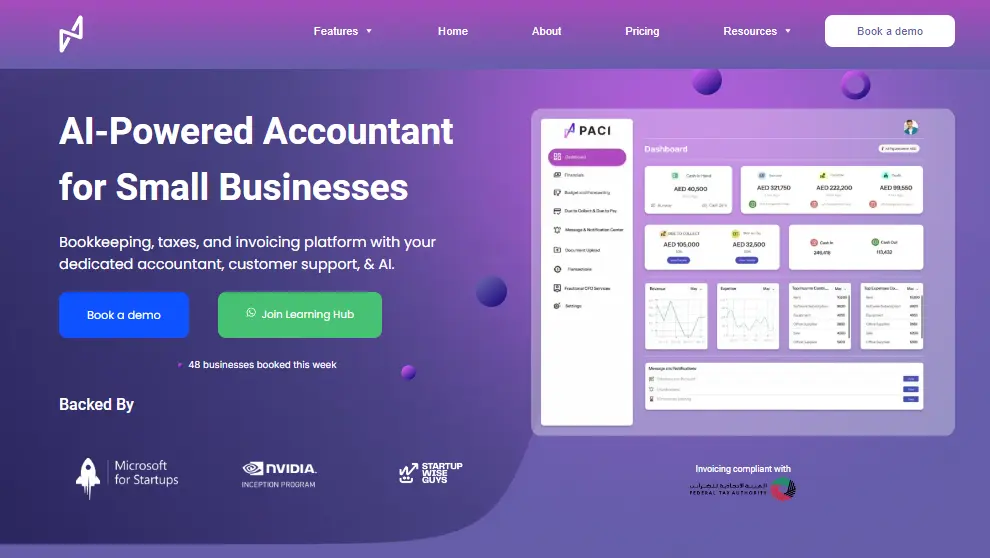

How Paci.ai Helps in Small Business Finance Management

- Automated Expense Tracking

By tracking and classifying spending in real-time, AI-powered automation minimizes errors and manual entry.

- Precise Reporting

Simplifies financial analysis and tax preparation by producing accurate financial reports instantaneously.

- Smooth Integration

Easily synchronizes with accounting software like Xero and QuickBooks, guaranteeing that all data is current.

- Automation That Saves Time

Removes time-consuming financial tasks, giving you more time to concentrate on expanding your company.

- Real-Time Insights

This accesses current financial data, facilitating more intelligent decision-making for improved money management.

Our Services includes:

- Easy Transaction Management

- Real-Time Financial Dashboard

- Seamless Receivable Payable Management

- Tax Preparation Made Easy

- Bookkeeping Tax Suite

- Compliance And Accuracy

- Customized Insights and Financial Advisory

Final Thoughts

Using an intuitive expense report template makes controlling expenses for small businesses less time-consuming. It also helps companies keep accurate cost records, effectively manage spending, and guarantee compliance throughout tax season.

With the help of a well-structured template, small business owners can concentrate more on expanding their companies and less on tedious data entry.

Expense monitoring is made even simpler by using AI-powered solutions like Paci.ai. These automate time-consuming operations and offer real-time financial dashboard insights to ensure accuracy and save valuable time.

Connect with us for more information on expense report templates for small businesses.