Cost of Goods Sold (COGS): Definition and How to Calculate It

Any company trying to control its profitability has to understand the cost of goods sold (COGS).

“COGS” refers to the actual costs of manufacturing your items, such as labor, raw materials, and overhead. When computed correctly, COGS gives you a clear view of how much you’re spending to make money. This enables you to set reasonable prices and efficiently manage your profits.

Precise COGS computations include more than just math operations. They impact important company choices, including budgeting, inventory control, and pricing tactics.

If you’re not closely monitoring your COGS, you may accidentally damage your business’s profitability with your decisions.

Paci.ai can help in this situation. Paci.ai streamlines money administration by integrating AI-powered automation with professional financial services.

Thus, this blog clearly explains COGS and how it can be calculated.

What is the Cost of Goods Sold (COGS)?

The financial indicator known as Cost of Goods Sold (COGS) shows the direct costs incurred by a business while manufacturing items or services that are sold to consumers. These expenses consist of labor, supplies, and manufacturing overhead that are directly related to the manufacturing process.

COGS essentially answers the following query: How much did it cost to produce the goods or services that we sold?

The formula for determining gross profit (Gross Profit = Total Revenue – COGS) depends heavily on COGS.

Businesses may see from this statistic how efficiently they generate items compared to sales.

Lower COGS compared to sales indicate better profit margins, but greater COGS points to potential bottlenecks that could reduce profits.

One of the first elements following revenue in the income statement, COGS, is crucial to determining gross profit. It creates the foundation for deciding how successfully a company handles the ratio of its revenue to its manufacturing expenses.

Why COGS is Important for Businesses

1. COGS determines Product Price

Setting your product’s price without thinking COGS resembles blind flying. COGS enables you to establish pricing that will pay for your costs and leave you with a healthy profit margin. This helps you provide the actual cost of manufacturing each unit.

For enterprises, this involves creating steady revenue streams and meeting manufacturing costs. You may be underpricing, which reduces profits, or overpricing.

This turns away clients if you need a clear picture of your costs.

Companies can make data-driven pricing decisions that guarantee competitiveness without compromising revenue by closely monitoring COGS.

2. COGS’s Effect on Revenue and Tax Calculations

Your gross profit, calculated as revenue less COGS, is directly impacted by COGS. While a lower COGS boosts profitability, a higher COGS will reduce your gross profit and margins.

For this reason, companies frequently aim to maintain the lowest feasible COGS without compromising quality.

Furthermore, since COGS lowers your taxable income, managing and comprehending COGS well might help you pay less.

By appropriately estimating COGS, businesses can ensure they are reporting the correct numbers on their income statements. This impacts everything from tax liabilities to investor confidence.

3. Managing COGS to Boost Operational Effectiveness

Your manufacturing or supply chain processes may have inefficiencies that can be found by monitoring and managing COGS.

Analyzing the factors influencing your cost of goods sold (COGS), such as labor, overhead, or raw material costs, can pinpoint areas for cost reduction and streamlining. This increases operational efficiency while also increasing profits.

Managing costs of goods sold (COGS) is essential to operating a lean, productive business. This can be done through improved vendor negotiations, manufacturing process optimization, or AI-driven insights.

What Costs are Included in COGS?

Comprehending your Cost of Goods Sold (COGS) components is essential for precise computation and effective management of your company’s profitability.

The costs directly associated with manufacturing the items or services you sell make up your cost of goods sold (COGS).

Let us divide these crucial elements:

1. Direct Materials

One large portion of COGS is the raw materials used to manufacture your goods.

For instance, if you’re a manufacturer, this would contain the polymers, metals, and other materials used to make the product. You will only get correct profit margins if you include the precise cost of these materials in your COGS calculation.

2. Direct Labor Costs

COGS also includes labor expenses directly related to manufacturing services or products.

Pay for employees working on assembly lines, in factories, or in other positions that directly contribute to manufacturing.

It’s crucial to remember that salaries for administrative and sales personnel are not included in COGS. However, only labor expenses are directly related to manufacturing.

3. Overhead Charges

COGS also includes overhead expenses that are directly tied to the manufacturing process.

These could include amortization for producing equipment, servicing costs for equipment, and utilities (such as water and electricity) needed in the manufacturing procedure.

By including overhead expenses in your COGS, you can be sure that you are accounting for all production costs, not just labor and materials.

4. Shipping & Freight (Before Reaching Customers)

Cost of goods sold (COGS) includes freight and shipping expenses related to moving items between manufacturing sites or delivering raw materials to your business.

Shipment costs, not COGS, are typically included in selling expenditures when delivering the finished product to clients.

How to Calculate COGS: Step-by-Step

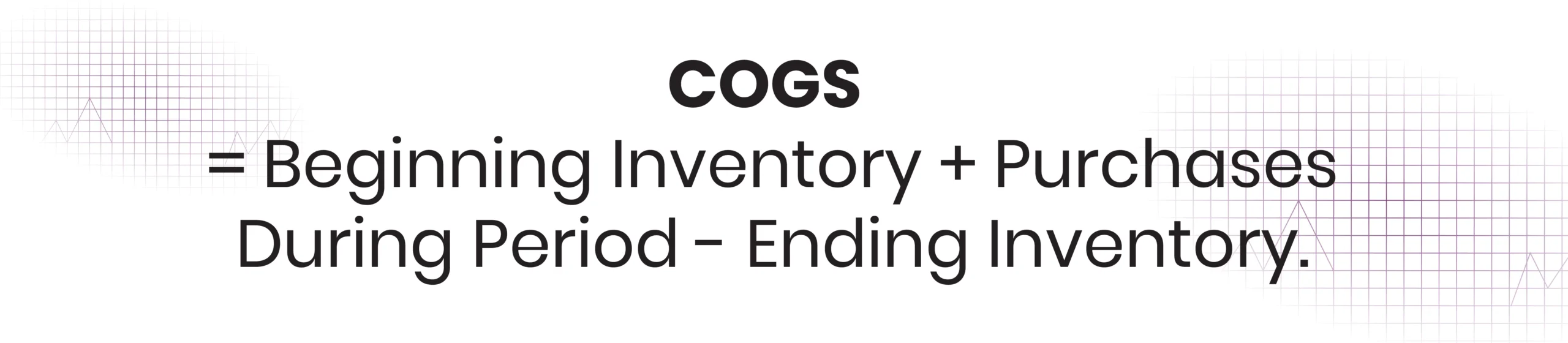

COGS Formula:

It’s unnecessary to make Cost of Goods Sold (COGS) calculations too complicated. Let us simplify it into a straightforward procedure.

Here’s how you step-by-step understand and use this formula:

1. Beginning Inventory

This is the amount you had for products at the beginning of the period, usually at the start of the quarter or fiscal year. All goods or materials prepared for sale or use in manufacturing are included.

2. Purchases During Period

The next step is to include any purchases you made within that time. This consists of any supplies you purchase to maintain the flow of your manufacturing or sales process, such as finished goods or raw materials. Make sure to factor in direct expenses such as shipping or freight to deliver the materials to your business.

3. Ending Inventory

You determine the worth of the Inventory you still have on hand at the close of the period (for example, the end of the year or quarter); this is your ending inventory. This value includes excess raw materials and unsold finished goods.

Final Thoughts

To properly understand your business’s revenue, you must accurately calculate your Cost of Goods Sold (COGS).

In addition to impacting your gross profit, COGS is a significant factor in tax computations. Thus, it helps guarantee you pay the appropriate amount while maximizing deductions.

By keeping a precise grasp of your COGS, you may obtain more insight into your company’s performance and make more informed decisions regarding pricing, inventory control, and operational effectiveness.

Nevertheless, manually tracking COGS can be error-prone and time-consuming. This is where AI-powered solutions like Paci.ai come in handy.

Using Paci.ai to manage your finances more efficiently can simplify your bookkeeping and allow you to focus on expanding your business.

Connect with us for more information and insights on COGS and financial management.