Paci.ai vs Traditional Bookkeeping

Decades ago, there was only one option: hire a freelance bookkeeper or use a traditional bookkeeping process.

Initially, people executed the bookkeeping and accounting process manually. However, with the advent of the latest technologies, these processes have shifted to online. Some SMEs and SMBs still follow the traditional bookkeeping process.

As the internet and software have become cheaper, the accounting process has transformed to online platforms. The difference is that the way things worked changed, but the concepts remained the same.

You can do any business you prefer in a dynamic business environment. But to ensure your business thrives, you must keep good control of your finances. Effective bookkeeping services are not essential; they are the backbone of a successful business.

In this blog, we will discuss the difference between traditional bookkeeping and digital bookkeeping services like Paci.ai.

Traditional vs. Digital Bookkeeping

Traditional Bookkeeping

In past times, bookkeeping involved manually entering data into physical ledgers. It was labor-intensive, error-prone, and required much time and attention to detail.

Traditional bookkeeping also required a lot of time, which frequently caused delays and obstructions in company operations. Data entry clerks were the common perception of bookkeepers. Their primary role was maintaining records, and they often worked alone from different parts of the company.

Physical files containing data have limited cooperation and access. Information exchanged between departments or locations took time and effort.

Digital Bookkeeping

Modern bookkeeping for small business uses technology to manage tedious duties, drastically lowering errors and freeing specialists to concentrate on planning and analyses.

Regarding professional unity, today’s bookkeepers work closely with other departments and participate in strategic thinking and choice-making, making them an essential component of the company.

They serve as strategic counselors, financial analysts, and reliable consultants. This shift in role reflects a broader trend in business, where data-driven insights are more crucial for decision-making.

Virtual bookkeeping services like Paci.ai facilitate advanced artificial intelligence, yielding insights that promote growth, differentiation, and business effectiveness. Compared to traditional bookkeeping, Paci.ai’s computation precision has grown significantly. Even at the time of errors, they are quickly discovered and fixed.

This is why digital books are better than traditional bookkeeping services in Dubai.

Suggested Read: 5 Factors To Consider While Choosing An Accounting Service In Dubai. Here

Paci.ai – AI Powered Bookkeeping Services in Dubai

Organizations in Dubai and elsewhere have begun to depend on creative solutions that blend experience and technology to manage money effectively. Paci.ai is a leading supplier of top virtual bookkeeping services in Dubai, and it utilizes artificial intelligence (AI) to transform traditional bookkeeping services.

Along with the AI-powered solutions you will also get the assistance from an expert accountant to make your bookkeeping and accounting on track.

You can manage your performance, administer your company, and make the best choices based on data with Paci. Your personal bookkeeper gets to know your business, assists you in classifying your expenses, and maintains the organization of your records.

The real-time P&L statement template, balance sheets, cash flow, and tax compliance reports help you monitor your finances.

Here’s how Paci.ai distinguishes itself:

- AI + Human For Tax-Ready Reports

Paci produces precise, tax-ready reports by fusing AI accuracy with human knowledge. Always be ready.

- A quick look at financial trends

See current financial developments with Paci’s dashboard. You can make well-informed decisions by having access to data.

- AI to reduce manual process time

Utilize Paci’s AI technology to get rid of time-consuming manual labor. You concentrate on your business, and we take care of the math.

- Linked to widely used accounting software

Integrate Paci with leading accounting software like QuickBooks, ZohoBooks, and Tally. Simplify your financial information on a single, cohesive platform.

You will get these benefits if you connect with Paci.ai for your bookkeeping services.

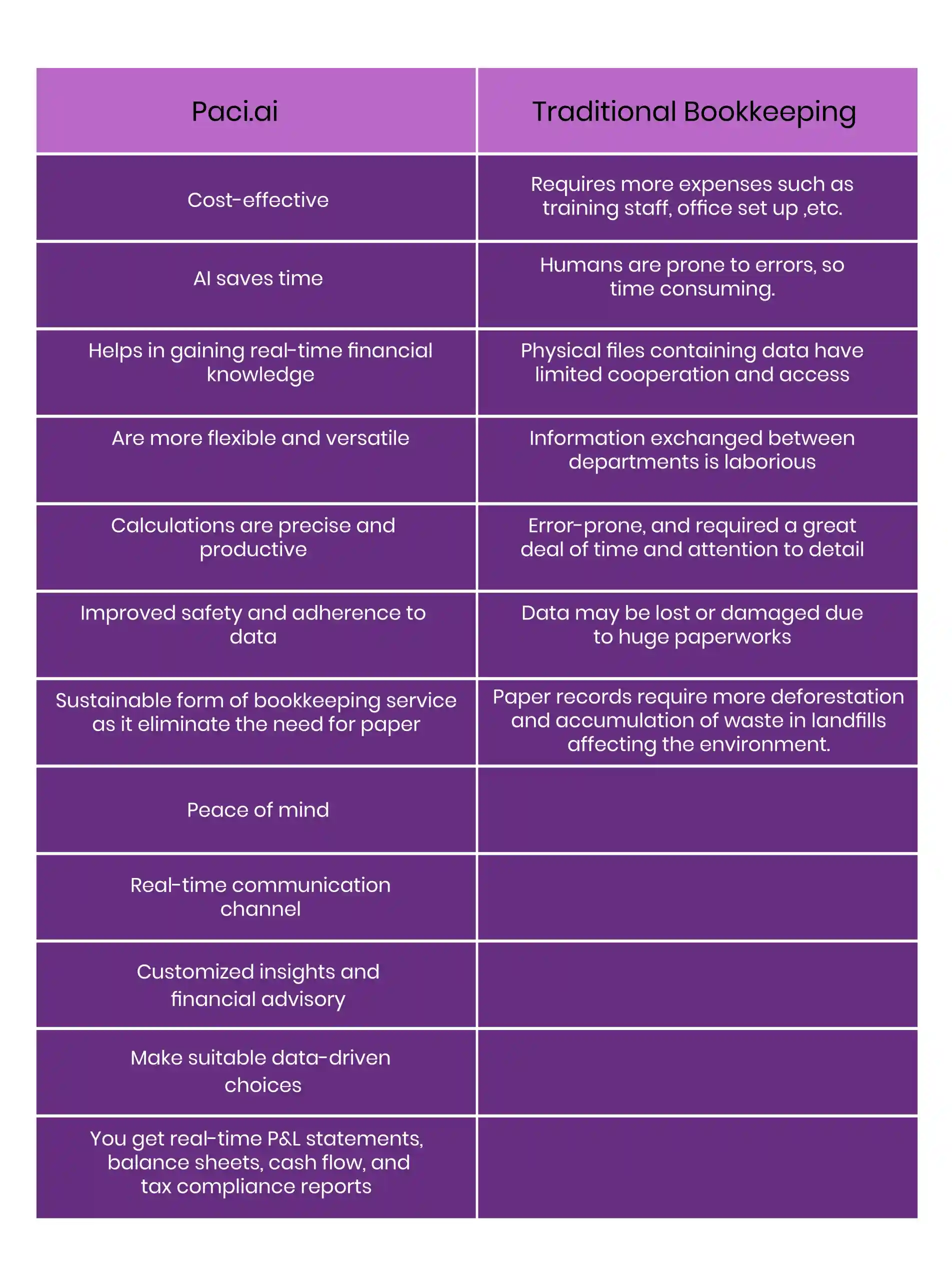

1. Cost-effective Services

Bookkeeping service cost is one of the main issues facing organizations, particularly startups and small businesses. Traditional bookkeeping services in Dubai might be costly since they require hiring outside consultants or full-time employees.

By automating repetitive operations, Paci.ai provides a more economical solution by minimizing the need for significant human work and cutting total service costs.

Although the bookkeeping service cost can vary greatly, Paci.ai strives to provide a reasonable pricing strategy without sacrificing quality. Traditional bookkeeping services include expenses such as office space, personnel, and perks.

On the other hand, Paci.ai offers precise and predictable price structures while automating the reduction of these expenses.

2. Real-Time Financial Knowledge

Businesses can obtain real-time financial insights using Paci.ai, which is frequently unavailable through standard bookkeeping services. The AI technology provides real-time reports and analytics by continuously updating financial records. CEOs and financial experts can now act swiftly and decisively with knowledge.

For example, in the event of unexpected spending, our expert accounting team can instantaneously display the impact on the company’s cash flow and make recommendations for potential improvements.

Further read: Bookkeeping tips for beginners

3. Precision and Efficacy

Manual data entry is a common component of traditional bookkeeping, which can be laborious and error-prone. Paci.ai’s AI-driven methodology automates these processes, guaranteeing precise and effective data recording.

For instance, AI solutions can provide financial reports and balance accounts and quickly classify spending with little human assistance, significantly lowering the possibility of mistakes.

Also read: Bookkeeping and Accounting Software: Tools for Managing Your Finances

4. Flexibility and Versatility

As businesses expand, they require more sophisticated financial management. Traditional bookkeeping services may find it challenging to grow effectively.

On the other hand, Paci.ai provides scalable solutions that are easily adjustable to growing numbers of transactions and new financial complications.

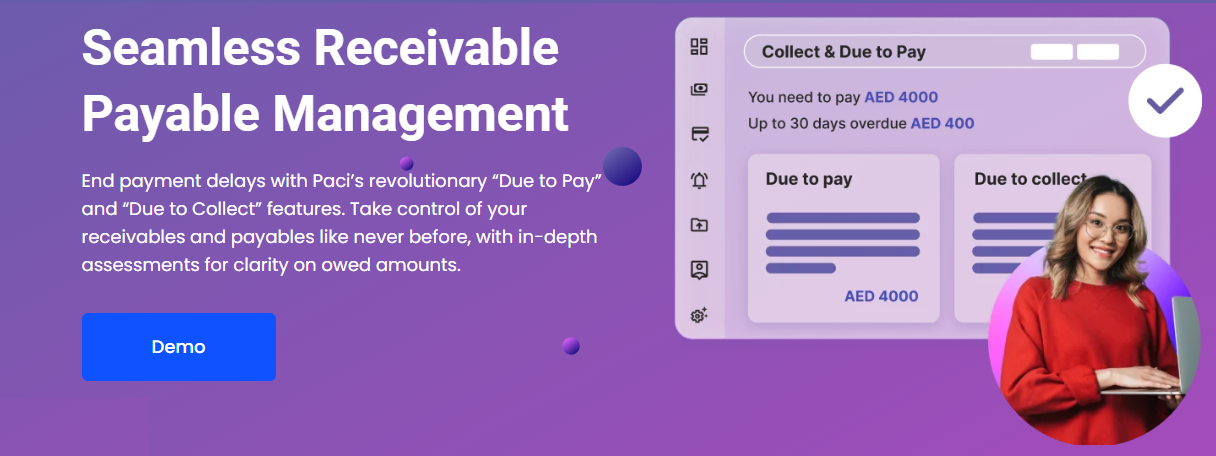

One of Paci’s services is easy transaction management, where our transactions page integrates all of your financial data into an extensive and trustworthy center. This brings together all of your transactions from other accounts, bank feeds, papers, and accounting software.

5. Improved Safety and Adherence

When digital bookkeeping is done using Paci.ai, financial data is safely saved with solid encryption and complies with international requirements. This ensures that businesses follow the law and reduces the likelihood of data breaches.

However, data loss, theft, or improper handling in a traditional bookkeeping system can cause significant stress to the company and its operations and be time-consuming.

For instance, a financial advisor handling confidential customer data may rely on Paci.ai’s robust security protocols to safeguard information and uphold adherence to industry standards.

Please Read: The Role of Technology in Modern Accounting Practices in the UAE. – Paci. Here

Final Words

It’s becoming increasingly evident that modern, AI-powered bookkeeping services, like Paci.ai, are superior to traditional methods. With its dependence on manual procedures, traditional bookkeeping is steadily becoming less attractive to companies looking for affordability, precision, and productivity.

In contrast, Paci.ai delivers a flawless fusion of cutting-edge AI technology and knowledgeable professional services, making it a better option than traditional methods.

This is the ideal time for people still using traditional bookkeeping services to transition. With Paci.ai, you can enjoy the advantages of modern bookkeeping and revolutionize your financial management.

So, join us now to gain more insights into bookkeeping services in UAE and how Paci.ai is unique in the market.

Suggested read: Bookkeeping For Travel Agencies: All You Need to Know