Using outsourced accounting services is key for managing finances. More companies choose to outsource their payroll and work with leading accounting firms. This helps them work and gain new business benefits.

Nowadays, businesses face more complex challenges. Managing money is about more than just basic bookkeeping. The importance of good accounting in making a business successful cannot be overstated. Outsourced accounting is great for businesses it helps them be accurate with money and follow the legal rules.

This blog explores the top reasons for embracing outsourced and virtual accounting services.

Let’s get started!

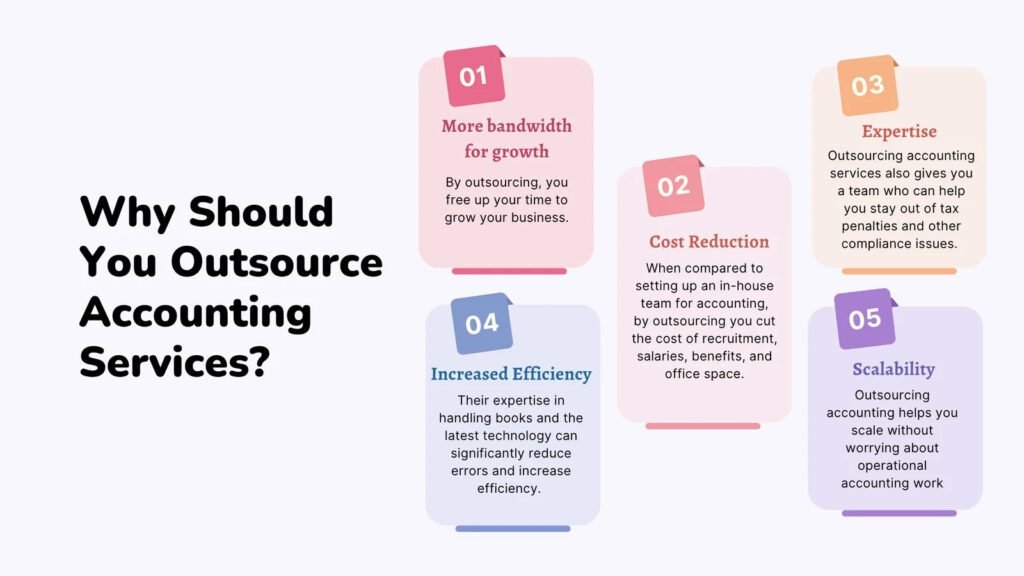

Reasons To Outsource Accounting Services

The financial needs of a business change as they grow, which makes outsourcing an appealing solution. So we showcase to you the 5 major reasons for outsourced accounting.

1. More Bandwidth for Growth

Outsourced accounting functions offer a strategic advantage for business leaders. This enables them to concentrate on core activities and strategic growth.

For instance, consider the case of a burgeoning e-commerce company. They turned to outsourced accounting and virtual accounting services. It also enabled them to divide more resources into product development.

As a result, the company saw a significant increase in its market share and customer base. This underlines the direct impact of outsourcing on business expansion and improvement.

The psychological benefits of outsourcing accounting tasks are profound. Business leaders often experience a sense of relief and clarity. This was when the burden of managing complex financial statements was lifted. This mental space is invaluable for strategic thinking and innovation.

Having an external team handle accounting complexities lets business owners focus on growth. Thereby exploring new opportunities and enhancing their products or services.

The operational and psychological advantages of outsourced accounting promote a safe business space. Companies can realign their focus by entrusting financial management to experts. They can concentrate on what they do best. This grows their business and improves their offerings in a competitive marketplace.

2. Cost Reduction

In today’s economy, every penny counts. The cost-effectiveness of outsourced accounting stands out as a compelling reason. This is for businesses to reconsider their financial management strategies.

Maintaining an in-house accounting department comes with a hefty price tag. This includes salaries and significant expenses in training, infrastructure, and technology upgrades. These costs can be particularly burdensome for some SMEs or startups. Still they are finding their place in competitive markets.

A Deloitte study found that outsourcing services can lead to cost reductions of up to 40%. This saving stems from eliminating direct labor costs. It also includes associated expenses like employee benefits, office space, and equipment.

Virtual accounting services, a subset of outsourced accounting, further amplify these savings. This is by leveraging remote work technologies. It includes reducing the need for physical office space and resources.

Moreover, outsourcing payroll services to top-rated accounting firms brings financial benefits. These firms often operate with economies of scale. They offer their services at a competitive rate rather than maintaining an in-house team.

- Flexibility

By outsourcing, businesses can convert fixed costs into variable costs. This provides greater flexibility in managing their financial resources. This shift is particularly beneficial during an economic recession. It is when companies can scale their accounting costs in line with their revenue streams.

- Absence of financial risks

Another cost benefit of outsourcing accounting services is the absence of financial risks. Traditional in-house departments need continuous investments in training and development. This is to keep up with the latest accounting standards and technologies.

Outsourced firms bear the responsibility and cost of staying current. They ensure that their clients benefit from the most up-to-date practices and systems. There is no need for extra investment.

3. Access to Expertise

Outsourced accounting provides businesses with access to this expertise. This helps in connecting them with the best accounting firms. Their specialized knowledge and skills know these. This access is crucial in an era where accounting includes compliance and strategic financial planning.

Outsourcing firms stay updated with the latest accounting trends and technologies. This ensures that their clients can enjoy the most advanced tools. Outsourced accounting is especially helpful in virtual accounting services. This is because of the use of cutting-edge software and cloud-based solutions. This results in more efficient, transparent, and accessible financial management.

The access to expertise offered by outsourced accounting is a game-changer for businesses. It allows them to leverage specialized knowledge and advanced technologies. This improves their financial operations and strategic capabilities. This access is not about handling the numbers; it’s about empowering businesses with insights and efficiencies that drive growth and success.

4. Scalability

Scalability is the most significant benefit of outsourced accounting. This adaptability is crucial in today’s dynamic market conditions.

Outsourcing accounting services, including virtual accounting, enables businesses to tailor their services. This is to match their current requirements. This flexibility is particularly beneficial for businesses experiencing seasonal fluctuations.

For example, a retail business may need more extensive accounting support. Especially during the holiday season. This is when transactions peak and less during off-peak months. Outsourcing offers the flexibility to expand these services. This is without the logistical and financial challenges of hiring an in-house team. Likewise, it allows for a reduction in services without the complexities of downsizing.

A real-life example of this benefit is in a tech startup. They experienced sudden growth due to a successful product launch. The startup developed its accounting services by partnering with an outsourced accounting firm to manage the increased financial activity without hiring extra full-time staff. This flexibility helped manage costs. Additionally, it ensured that the company could focus on capitalizing on its growth momentum.

The flexibility and usefulness of outsourced accounting services are great for businesses. Businesses benefit a lot from them. This adaptability ensures that businesses can manage their financial operations. This is regardless of their growth phase or market conditions. Thereby providing a strategic advantage in a competitive environment.

5. Increased Efficiency for Regulatory Compliance

Furthermore, virtual accounting services offer the advantage of streamlined processes and technology-driven solutions. It often leads to more efficient financial operations. This efficiency results in quicker turnaround times for financial reporting and analysis. It enables businesses to make timely and informed decisions.

The cost efficiency of outsourced accounting is not about direct cost savings. It includes a comprehensive financial strategy. This encompasses reduced operating expenses and flexible cost management. Additionally, it has access to advanced accounting technologies and expertise.

Take, for instance, a small business that outsourced its accounting responsibilities. They experienced increased safeguards against financial fraud and unintentional tax errors. The external team’s skills in risk management protected the business from expensive financial penalties and legal problems.

This level of protection is invaluable. As it not only secures the business but also upholds its efficiency and reputation in the market. Outsourcing accounting offers protection against the challenges of the ever-changing financial regulatory landscape. This shield is particularly valuable for businesses.

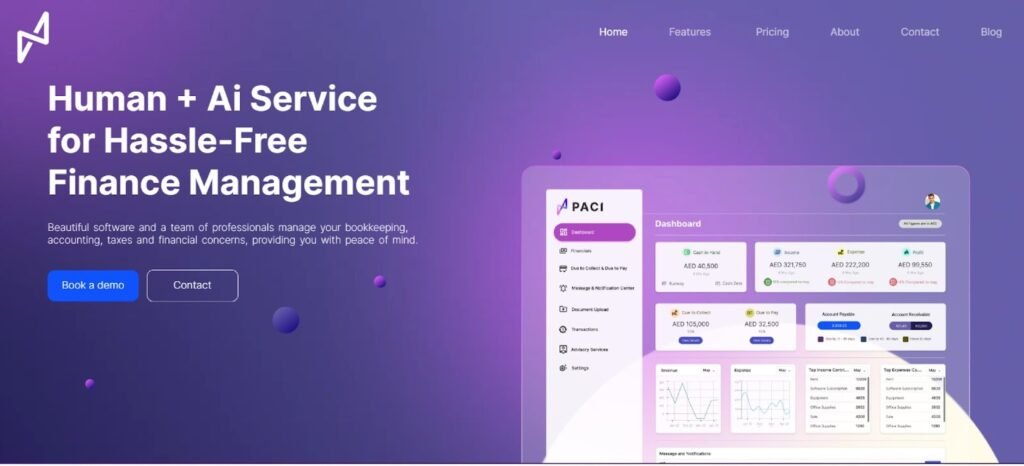

How Paci.ai Can Revolutionize Your Business Account Management

Success in today’s dynamic business environment depends on efficient financial management. Paci.ai emerges as a game-changer in this arena, offering a unique blend of human expertise and artificial intelligence to transform how you manage your business finances.

- Simplifying Financial Processes with Paci.ai

Paci is to simplify and streamline your financial processes. It eliminates the complexities associated with financial management.

Its innovative approach combines the precision of AI with the insight of human expertise. This Human + AI solution ensures that your financial operations are not automated. But also aligned with your business needs.

Paci.ai’s dashboard is a testament to its commitment to hassle-free financial management. It allows you to navigate through your financial data. This offers clarity and control over your finances.

- Focused on Your Business Growth

Paci.ai understands that your primary focus should be on growing your business. Paci.ai allows you to devote your energy and resources to what you do best by handling the intricacies of financial management.

Paci ensures that financial management doesn’t slow you down. This includes expanding your market reach or innovating your product line. Also enhancing customer experiences. Paci is committed to adapting and evolving to meet your unique business requirements. If there’s something you need that isn’t currently offered.

Choosing the Right Outsourcing Partner

You must connect with a top-rated accounting firm for outsourcing. Thus, when selecting an outsourcing partner for your accounting needs, consider the following checklist:

- Reputation: Research the service provider’s track record. Look for reviews, testimonials, and case studies.

- Service Scope: Ensure the service provider offers a comprehensive range of services that align with your specific financial needs.

- Technology and Innovation: Evaluate their use of technology, especially in areas like AI and data security.

- Security Measures: Understand their data protection policies and compliance with financial regulations.

- Personalization and Flexibility: Check if they offer customized solutions and can adapt to your business’s changing needs.

- Expertise and Support: Assess the quality of their team and the level of support they provide.

Conclusion

As highlighted in this blog, outsourced accounting services offer unparalleled benefits. This includes cost efficiency and access to expert knowledge. Also, it focuses on core business functions, scalability, and enhanced compliance. Embracing this strategic approach with finance management platforms like Paci.ai has two benefits. It not only streamlines financial management but also propels long-term business success.

With Paci.ai, you’re not selecting an outsourced accounting service. You’re welcoming a partner dedicated to the financial well-being and growth of your business.

Connect with us right now so you can ensure that your outsourcing choice aligns with your business objectives.