Influencer accounting is a specialized but essential field that is becoming popular in the dynamic UAE market. Given the continued effect of social media on our dining and fashion choices, it is critical to comprehend the intricate financial aspects of it.

The complexities of taxation, budgeting, and the effective distribution of resources for expansion and sustainability challenge many influencers. It’s a delicate balancing act that calls for financial management and content creation knowledge.

This highlights that influencer accounting is a holistic method to monitor the financial health of those who educate and entertain us on social media. It is not simply about tracking profits and expenses.

A light in the unclear world of influencer accounting is an integrated finance service platform that offers the right finance management services. Thus, this blog will provide influencers with the information and resources they need to navigate their financial environment.

Understanding Influencer Accounting

Let’s look at a subject that may not be as exciting as your most recent post. However, it is vital as your reach and engagement metrics t: Influencer Accounting.

Knowing the financial side of your creative efforts is essential to transforming your passion into a successful career. This is regardless of how established you are as an influencer in the UAE or how recently you are making waves.

When Do Influencers Need to Learn Influencer Accounting?

You may ask yourself, “When do I need to get serious about learning the ins and outs of accounting for my influencer business?” The answer is easier than you might think: it’s right now.

1. The Moment You Decide to Monetize Your Influence

The decision to turn your passion into a venture is the first step means understanding the financial ramifications is essential. It is regardless of whether you’re negotiating compensated collaborations or are just beginning to receive free things in exchange for postings.

2. When Your Brand Begins to Grow

The complexity of your finances will increase with the number of followers and engagements you receive. Expanding your knowledge of influencer accounting throughout this growing era is crucial. You’ll have to deal with sponsorships, advertising revenue, and even sales of items. Specific financial considerations are associated with each of these income streams, ranging from taxes and deductions to invoicing and payment.

3. Before Tax Season

Tax season is the one time of year that emphasizes the need for a basic understanding of accounting. Knowing what taxes you owe is essential in the UAE and many other countries. This entails understanding the requirements for reporting your income, qualifying for deductions, and adhering to UAE tax laws. You may avoid problems and ensure you don’t lose money by being organized.

4. When Making Future Plans

It’s part of your job description to have great aspirations, but achieving those dreams demands preparation. Knowing your financial situation is crucial, whether your goal is to grow your business, buy new equipment, or put money aside for the future. Financial planning can assist you in making decisions that align with your objectives.

UAE Influencer Tax Regulations and Financial Management

The requirement to uphold transparency and compliance with the Federal Tax Authority (FTA) shapes the tax environment for influencers in the UAE. Knowing your tax responsibilities is essential, regardless of whether you work as a full-time influencer or manage content creation alongside another job.

Influencers who receive payment through various means, such as affiliate marketing, sponsored content, or brand partnerships, must register for VAT if their yearly income surpasses the AED 375,000 registration requirement.

Also read 5 Simple Steps To UAE Corporate Tax Registration Here.

Consequences of Non-Compliance

Ignoring tax laws is like not wearing sunscreen in the desert; you’ll be burned eventually. Penalties, fines, and even harm to your professional reputation may result from non-compliance. As trust is your most valuable asset in social media, staying compliant with tax rules is a must. It’s essential to focus on developing a credible, long-lasting brand rather than just avoiding penalties.

Financial Management for Influencers

We’re going to talk about something that might not make your heart race, like a viral post. But trust us! The art of bookkeeping and financial management are equally crucial to your influencer journey. You heard correctly—bookkeeping! Not only for the suits but for those who create material like you, it’s revolutionary.

Why Bookkeeping Should Be Your New Best Friend

Handling your company’s finances is essential, even though it may not be as attractive as producing content. For several reasons, bookkeeping—the act of keeping track of and arranging all of your financial transactions—is essential. To begin with, it provides you with an unmistakable image of your financial situation. Whether you’re attempting to control your spending or budget for your next major project, this advice is priceless.

But strategy is just as important as tracking. You may make well-informed decisions regarding your content and relationships by identifying trends in your income and expenses with well-organized financial records.

It also comes in quite handy during tax season. Imagine having your financial data organized and ready to go so you can ensure you’re utilizing all of your credits and deductions. There will be no more rushing at the last minute or passing up possible savings.

Financial Management Tips for Influencers

1. Maintain Perfect Records

Begin by arranging your money transactions. Keep a record of it all, no matter how minor the spending or revenue. Developing this habit can help you see your financial health clearly and make filing taxes easier.

2. Recognize Your Expenses

Not every expense is the same. Understanding which costs are deductible from taxes and which aren’t can significantly impact your total income. Invest to learn these subtleties, or enlist expert assistance.

3. Tax Planning

To avoid being caught off guard when making your tax payments, plan ahead and set away a portion of your income for taxes. Consider it an unavoidable cost, similar to your internet service provider.

4. Seek Professional Assistance

With constantly changing regulations, the world of taxes may be very complicated. Working with an expert, such as the right integrated finance management platform can help you save a lot of headaches, wasted time, and financial loss.

Influencers like you can focus on growing your business while we take care of the financial details with our bookkeeping and tax suite, which is meant to keep you out of trouble.

5. Remain Up-to-Date

The rules governing the digital world are constantly changing. Make it a point to keep up with the most recent financial management and tax legislation developments. Particularly when it comes to handling your finances, information truly is power.

Choosing The Best Influencer Accounting Services platform

Remembering the business aspect of your influencer journey as you make your way through the fascinating world of content creation is critical. This is particularly true when it comes to money management.

Now, we will select the top influencer accounting services that will fulfill your requirements and elevate your company to new heights.

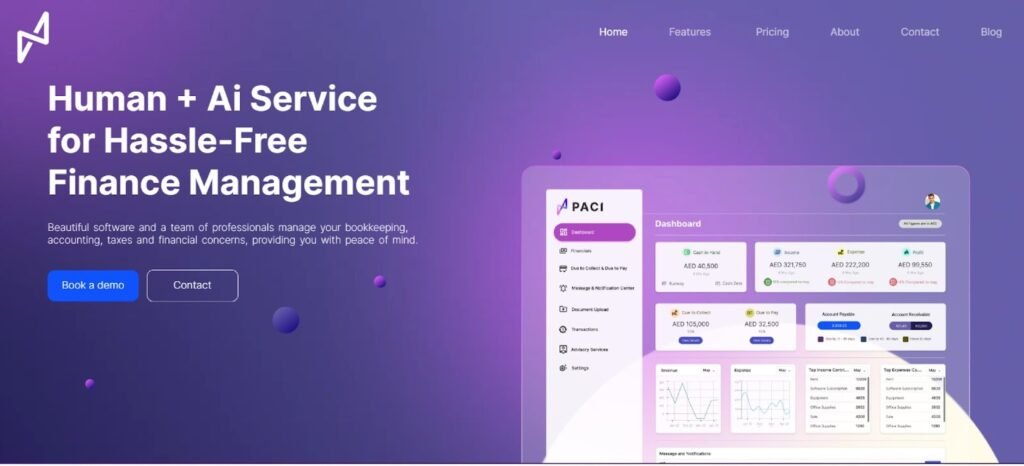

How Paci.ai Can Be a Better Choice for Accounting Services

There are a few essential aspects and services to look for while searching for the ideal accounting service like Paci.ai.

Key Features of Paci.ai Software

- Real-Time Financial Insights Dashboard

- Tailored Bookkeeping & Tax Suite

- Seamless Receivable and Payment Management

- Real-Time Communication Channels

- Customized insights & Financial advisory

- Easy Transaction Management

Also read Basics of Bookkeeping for Small Business – Paci Here.

What to Look For in a Best Accounting Services Platform?

1. Expertise in Creative and Influencer Sectors

You need a provider that comprehends the subtleties of your line of business. An accounting service platform knowledgeable of the influencer market can help you with anything from handling unusual expenses to managing several revenue streams.

2. All-inclusive Tax Assistance

Seek out providers who assist you with comprehensive tax consultancy services, encompassing comprehension of UAE influencer tax laws and worldwide tax responsibilities if your business expands outside, in addition to standard bookkeeping services.

3. Real-Time Financial Insights

Access to real-time financial data can help you make quick, well-informed decisions about your brand and business in the fast-paced world of social media.

4. Customized Support

Your accounting requirements and brand are distinct from one another. Your approach to financial management may be revolutionized by a service that provides individualized guidance and solutions.

5. Scalability

Your financial requirements will change as your brand expands. Having an accounting service that can grow with you is invaluable and provides anything from simple bookkeeping to CFO-level guidance.

6. Growth-Ready

Paci.ai’s services scale with you, offering the appropriate support at every point of your journey, regardless of when you’re just getting started or ready to take your brand to the next level.

Finding the Best Option for Your Brand

Selecting the appropriate accounting service is an essential choice for your influencer brand. Take into account your long-term objectives, business scale, and unique needs. Are you seeking strategic financial counsel to build your business or need someone to keep your books organized? Consider whether a prospective service can meet these needs now and in the future.

Connect with Paci.ai for individualized guidance and solutions. Our team is prepared to learn about your brand and assist you in navigating the financial facets of your influencer career.

Connect with us! Together, we can make your financial management as profitable and easy as your content creation.