Knowing how to compute VAT in Dubai is crucial if you’re a manager, non-resident firm owner, or business owner in the UAE. Value Added Tax, sometimes known as VAT, is a consumption tax that is applied to goods and services at every point in the supply chain.

It is noteworthy, then, that if your annual profit exceeds AED 375,000, you will have to register for VAT. If one’s yearly income is between AED 187,500 and AED 375,000, one may choose to voluntarily register for VAT.

In the United Arab Emirates, all VAT-registered enterprises must pay VAT when purchasing goods or services and collect it when selling them. As a result, computing VAT is a regular activity for all types of enterprises.

So, in this blog, we’ll show you a step-by-step guide on calculating VAT in Dubai.

Understanding VAT in Dubai

On January 1, 2018, the Federal Tax Authority implemented Value Added Tax (VAT) on all goods and services provided within the UAE. Sales tax known as VAT is levied on taxable goods.

What is the VAT rate in Dubai, then?

- Some products and services in Dubai are excluded from taxes or charged at zero percent.

- Conversely, the typical rate for a lot of the products or services is 5%.

Since the introduction of the VAT standard rate, all firms in the UAE have been required to comply with VAT registration or risk fines. This could cause operational disruptions for the company and ultimately damage the reputation and image of the brand.

These are the main justifications for becoming educated about how to calculate VAT in Dubai.

Also Read – Types of VAT and VAT Registration Criteria for Different Business Types. Here

VAT Calculation Formula in Dubai

The standard VAT rate in Dubai is 5%, which is legally introduced and is also considered the lowest charge compared to other countries.

You may note that the UAE government is not directly involved in collecting taxes from businesses. However, businesses and sellers are accountable for imposing VAT on their customers while purchasing. This is why VAT is also known as an indirect consumption tax.

Now, let’s move on to understanding what an output tax and input tax imply.

Output Tax

The tax that is collected as a proportion of the final product’s selling price by the vendor or the business is known as output tax.

Stated differently, output tax refers to the tax collected during the sale of goods or services.

For example, if Mr. X sells a product worth AED 500, then the output tax (VAT collected after sales) is:

500*5% (VAT rate) = AED 25.00.

Input Tax

The tax that is charged by the seller as a proportion of the cost price when a customer purchases a good or service is known as input tax. The Recoverable VAT or VAT Credit is another name for the input VAT.

Put differently, input tax refers to the tax that customers are required to pay when they make purchases of goods or services.

For example, Mr.Y purchased products worth AED 400 with a 5% VAT rate. Now, the input tax will be 400* 5% = 20.00.

Step-by-Step Guide on VAT Calculation

Now, we can get onto the simple steps in calculating the VAT rate in Dubai.

Step 1: Determine the VAT Rate

The VAT rate set by the UAE government is 5% as of 2018. Nonetheless, certain products or goods with a 0% VAT rate are excluded.

Therefore, you need to be aware of your VAT rate if you are a startup, a businessperson, or a commercial entity.

You also need to register for VAT if your annual profits exceed AED 3,75,000 in total.

Step 2: Calculate the Output Tax

Calculate the output VAT Amount

For the calculation of the output VAT amount, follow the formula,

Step 3: Calculate the Input Tax

Calculate the input VAT Amount

For the calculation of the input VAT amount, follow the formula,

Step 4: VAT Calculation

The VAT rate can be computed by subtracting the input rate from the output rate once the input and output VAT amounts have been determined.

VAT = Output Tax – Input Tax

You can also calculate the final price of the product by adding the VAT amount to the total amount.

For example,

Take the example of AB Enterprises, a manufacturer that spent AED 300,000 on buying raw materials.

AED 300,000 * 5% = AED 15,000 is the input tax.

In the meantime, they earn a profit of AED 500,000 from the sale of products manufactured from raw materials. Now, the output tax is 5%, = AED 25,000 (multiplied by AED 500,000*5%).

So, the net VAT payment that AB Enterprises has to pay is as follows;

Output Tax – Input Tax = AED 25,000 – AED 15,000 = AED 10,000.

Also Read: Step-by-Step Guide to VAT Registration Process for UAE Companies. Here.

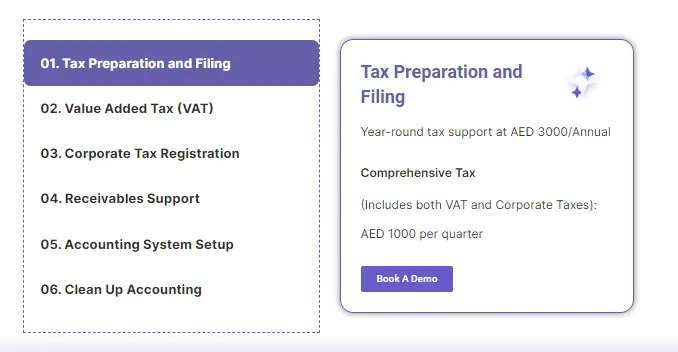

Why Paci.ai for VAT Services in Dubai

Paci.ai provides an exclusive platform and a personal accountant pair that is intended to guarantee fast, precise, and well-organized financial management.

Our intuitive interface helps owners and operators regain control by demystifying money. You get more from Paci.ai than just software—you get a partner committed to providing thorough accounting oversight to support your decision-making.

You may also consider the pricing for our assistance. We are highly transparent in our pricing structure, which is tier-based and based on the average monthly transaction volume.

Our primary services include:

- Real-time Financial Dashboard

- Real-time Communication Channel

- Bookkeeping & Tax Suite

- Customized Insights & Financial Advisory

- Seamless Receivable Payable Management

- Easy Transaction Management

Final Thoughts

As we come to the end of the blog, you may have a good understanding of the VAT rate in Dubai and how to calculate it. Understanding the importance of the VAT rate is essential for businesses in Dubai, as failure to properly address the VAT registration process might result in huge disruption to your business.

In light of this, Paci.ai, as an integrated finance management platform and the best tax consultancy service provider, is committed to providing you with all the necessary details and information about VAT rates in Dubai. Additionally, we assist you with calculating VAT rates in Dubai with fewer worries and better peace of mind.

So, why are you waiting?

Join us now to get more information on finance management and tax-related queries.