In the UAE, there is 0% tax up to AED 375,000 on taxable income. This is considered as advantageous for businesses.

With recent modifications to its business tax structure, the UAE is attempting to stay ahead of worldwide tax standards. These reforms might have a big effect on firms in a number of areas, such as tax planning and foreign investment.

Understanding the shifting trends is necessary to navigate the corporate tax rate in UAE. For this reason, it is imperative that you establish a relationship with an appropriate integrated finance management platform. It’s not only about compliance; it also leverages tax policies to your advantage.

This blog will highlight the factors that may affect your business and influence the corporate tax rate in UAE.

Also read: 5 Steps to Corporate Tax Registration in the UAE here.

What is the Corporate Tax Rate in UAE?

For taxable income over AED 375,000, the usual corporate tax rate in the UAE is 9%. There is no tax on profits up to AED 375,000. This is the corporate tax UAE latest news. As on June 1, 2023, firms that begin their first fiscal year will be subject to this new tax structure.

Factors Influencing Corporate Tax Rate in UAE

The significant factors that influence the corporate tax rate in Dubai are briefly discussed below.

1. Economic Diversification Efforts

The UAE’s diversification of the economy plan has a major impact on the corporate tax climate. The United Arab Emirates is generating new prospects for growth in sectors such as renewable energy, technology, and tourism by expanding its focus beyond oil and gas.

This modification seeks to encourage innovation and efficiency. In addition, it also aims to lessen reliance on conventional revenue sources.

As these industries grow, we might see the establishment of tax laws intended explicitly to aid in their development.

For example, tax reductions or incentives could be provided to draw capital into tech startups or renewable energy projects.

Businesses operating in the UAE have both possibilities and problems as a result of this changing economic environment. It is imperative for organizations seeking to adapt and prosper in this ever-changing environment to monitor how these diversification initiatives influence tax laws.

2. Government Policies and Regulations

Government policies and regulations significantly shape the corporate tax system in the UAE. The government’s intention to align the system with international tax norms is demonstrated by its planned implementation in June 2023. This move aims to preserve economic competitiveness.

Within the current system, major modifications are expected to tax rates, exemptions, incentives, and regulations for compliance. Organizations conducting business in the UAE have to recognize the complexity of these restrictions. Following the rules isn’t enough. It would be best if you also used them to your advantage while implementing a financial strategy.

Businesses hoping to successfully navigate the changing tax landscape will need to stay informed about those changes. The government continuously updates its tax code in an attempt to support economic expansion and preserve its fiscal stability.

Businesses established in the free zones of the UAE occasionally receive tax breaks. For a set period, the UAE corporate tax-free zone temporarily has a 0% corporate tax rate. For new businesses and international corporations looking to lower their tax burdens, this can be a huge benefit.

3. Global Taxation Trends

The corporate tax system in the UAE is shaped in large part by trends in global taxation. The nation’s participation in the OECD’s Base Erosion and Profit Shifting (BEPS) initiative demonstrates its commitment to adhering to international tax standards.

This agreement has an impact on the tax policy of the UAE, especially on issues like transparency, information exchange, and combating tax evasion. It’s critical for companies doing business in the UAE to be aware of these worldwide trends.

These developments impact foreign business in addition to tax planning. By adhering to these criteria, the UAE ensures that its tax policies stay applicable and efficient even as the global tax landscape changes.

As a result, companies in the UAE are better able to stay legal and relevant in the international market.

Impact of Corporate Tax Rates on Businesses

Corporate tax rates play a vital role in determining business operations in various industries. The major impacts of corporate tax rates on business in the UAE are listed in the following sections.

1. Financial Planning and Strategy

The financial strategy and planning of businesses are significantly impacted by the corporate tax rate in the UAE. A well-thought-out tax strategy can significantly reduce tax payments, leaving up more money for venture capital and growth.

Companies must consider taxes when determining how much money to set aside, what to put it in, and how to grow. Profits and market edge can be increased through efficient tax planning that emphasizes utilizing tax exemptions and incentives.

2. Industry-Specific Considerations

Regarding corporate tax rates, many industries encounter different possibilities and limitations.

For instance, certain tax laws may need to be carefully navigated in industries like finance and real estate. It’s essential to comprehend the complicated details of your industry’s tax laws to comply with regulations and minimize tax obligations.

Keeping updated on tax developments that are relevant to a given industry can provide one an edge over rivals and guide strategic choices.

3. Attracting Foreign Investment

A major attraction for international investment in the UAE is its favorable corporate tax rate. These countries tend to draw investors since a good tax environment directly impacts an investor’s return on investment.

The UAE is a popular destination for international investors because of its business-friendly laws, advantageous location, and efforts to maintain low tax rates. Companies in the UAE might take advantage of this benefit by drawing in outside funding and alliances.

Role of Integrated Finance Management Platforms

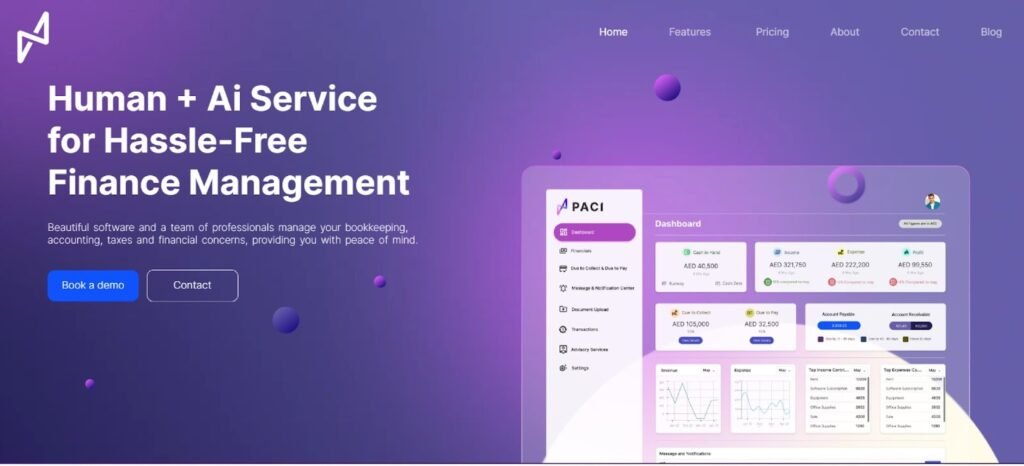

Leading the way in integrated finance management, Paci.ai provides a unique blend of AI-driven solutions and human expertise. It guarantees compliance with the UAE’s changing tax regulations by streamlining the complexity of business taxation.

The significant benefits of integrating a finance management service like Paci.ai with your business help in:

- Simplifying Financial Procedures

Financial process simplification lowers errors and saves time by automating tedious tasks, including computations, reporting, and tax filings.

- Providing Real-time Financial Insights

Paci.ai gives companies a thorough understanding of their financial situation so they can make wise decisions.

- Supporting Strategic Decision-Making

Give companies control and transparency over their finances so they may concentrate on expansion and strategic goals.

- Improving Tax Strategy

Assist companies in making the most of their tax strategy by making efficient use of tax breaks and incentives.

- Ensuring Compliance

Reduce the likelihood of fines and legal complications by keeping firms up to date on the most recent tax legislation.

Final Thoughts

Beyond merely complying with regulations, understanding the corporate tax environment in the UAE necessitates a strategic grasp of the variables affecting tax rates. Businesses must keep up with the latest developments in order to make wise decisions, economic diversification efforts, and global taxation trends. This is where finance management platforms come into play.

Businesses can easily handle the complexity of tax laws using Paci.ai. Our real-time financial insights and streamlined tax compliance enable firms to handle tax-related difficulties easily. This eases their minds and enables them to focus on what matters most—raising the financial viability of their business.

Connect with us right now if you have any questions about your finance management and corporate tax rate in UAE.