Are you feeling overwhelmed by the buzz around Dubai’s new corporate tax rules for 2024? You’re not alone.

With changes on the horizon, it’s natural to wonder how this will affect your bottom line and operational efficiency. But here’s it – understanding these changes can unlock new opportunities for your business.

Every company leader worries about compliance, how new policies will affect cash flow, and how difficult it will be to incorporate them into current financial plans. The uncertainty of how these rules apply to you, particularly in free zones or for foreign-owned firms, adds another level of complication. This is regardless of your experience level as an entrepreneur or business magnate. With the best integrated platform, you can deal with the corporate tax rules in Dubai.

So, let’s start!

Corporate Taxes: What Are They?

Imagine if companies operated similarly to people—they would work hard, earn a living, and use some of that money to pay taxes that support the community’s needs. Corporate taxes are precisely a means for companies to support the federal government.

The New Corporate Tax Rules in Dubai 2024

Overview of the New Corporate Tax Rules

Let’s now discuss Dubai, a city that has, for the longest time in our memory, been associated with being “tax-free.” Due to its 0% personal and corporate income tax, Dubai has been a shelter for corporates and expats.

So, why the change, you might wonder?

Dubai is changing, and as it does, new customs must be adopted. Corporate tax laws in 2024 will dramatically change the UAE’s budgetary practices. However, complying with international economic growth and openness norms goes beyond only collecting taxes. The global financial landscape is becoming increasingly regulated, and Dubai is rising to take center stage.

This action also addresses sustainability. Even though Dubai’s economy has expanded, long-term success depends on diversification and sustainable development. One step toward ensuring that companies make a fair contribution to the country’s growth, as they do in other regions of the world, is the implementation of corporate taxes.

Please Read Things You will stumble upon while registering for Corporate tax. Here

Dubai will impose a corporate tax on business earnings beginning in the 2024 fiscal year. This follows an innovative step representing an abrupt change from its status as a tax haven.

The following summarizes the essential information regarding these new Corporate tax rules:

1. Tax Rate

On profits over AED 375,000, businesses will be liable to a standard corporate tax rate of 9%. By relieving small firms and startups of the tax burden during their crucial growth phase, this level is intended to support them.

2. Exemptions and Incentives

In line with Dubai’s strategic economic objectives, specific industries and investments will be excluded from taxes and other fees. This includes companies who operate in “UAE corporate tax-free zone” locations as long as they follow specific legal guidelines and don’t deal with the UAE’s mainland.

3. Compliance and Reporting

Annual tax filing and “Corporate tax registration” will be a part of the corporate compliance schedule. It is anticipated that comprehensive rules about the documentation and reporting standards will be made available, focusing on transparency and compliance with international accounting standards.

Impact of Corporate Tax Rules on Businesses in UAE

Dubai’s introduction of corporate tax is revolutionary for companies of all sizes.

This is how the landscape stands to be impacted by it:

1. Small to Medium Enterprises (SMEs)

Since only profits over AED 375,000 are subject to taxes, most SMEs may benefit from the tax threshold. By taking this action, the core of Dubai’s economy —smaller businesses—won’t be disproportionately impacted.

2. Large Businesses

The 9% tax rate is competitive for larger businesses compared to international norms. It is necessary to examine financial plans and tax preparation more closely to guarantee compliance and minimize tax obligations.

3. Foreign-Owned Businesses

By introducing a “tax in Dubai for foreigners” component, domestic and foreign enterprises will have equal opportunities. The new tax environment will require foreign investors to maneuver, and they must comprehend how it impacts their overall investment plan in the UAE and the repatriation of profits.

4. Free Zone Companies

To be eligible for various exemptions in the “UAE corporate tax-free zone,” firms must fulfill specific requirements. This affects how enterprises in the free zone run and engage with the broader UAE economy. It also entails limitations on business dealings with the mainland and compliance with new regulatory frameworks.

Corporate Tax Registration

Complying with the corporate tax registration process is essential.

This is a quick reference:

1. Registration Procedure

Companies must register for corporate tax using the official website of the Ministry of Finance in the UAE. As the implementation date approaches, more information about the portal and its specifics should become available.

Also read 5 Steps for Corporate Tax Registration UAE here.

2. Timelines and Recordkeeping

To get ready, businesses should acquire ownership records, financial statements, and other pertinent data. Businesses are recommended to begin preparing early to guarantee a smooth transition. This is to ensure that you do not miss the deadline even if exact tax filing and registration dates will be published.

3. Compliance

Following the guidelines and criteria for reporting established by the UAE government is just as important as registering and paying taxes.

How Businesses Must Prepare for Corporate Tax Registration

Implementing corporate tax in Dubai signifies a significant change in the business environment. Here’s how to prepare yourself for these adjustments:

1. Identify New Tax Rules

The first step is to familiarize yourself with the new corporate tax laws. Learn about tax rates, exemptions, and any industry-specific regulations. Comprehensive insights can be obtained from resources such as professional advisory and the UAE Ministry of Finance website.

2. Examine Your Company Structure

Determine whether your company structure conforms to the new tax laws. Consider whether realigning or reorganizing corporate operations could improve tax efficiency, particularly for companies with foreign ownership or those operating in free zones.

3. Financial Review & Planning

Examine your finances carefully to determine how taxes affect your business’s success. Incorporate tax compliance planning into your budgeting and financial strategy forecasting procedures.

4. Consult a Professional

Tax rules are often intricate and subtle. To ensure your company is compliant and in the best possible position, you can receive customized assistance by speaking with tax experts or legal financial experts focusing on UAE tax law.

5. Redesign Accounting Systems

Ensure your bookkeeping and accounting systems can handle the new tax regulations. This may entail installing new systems or updating existing software to manage tax calculations and filings effectively.

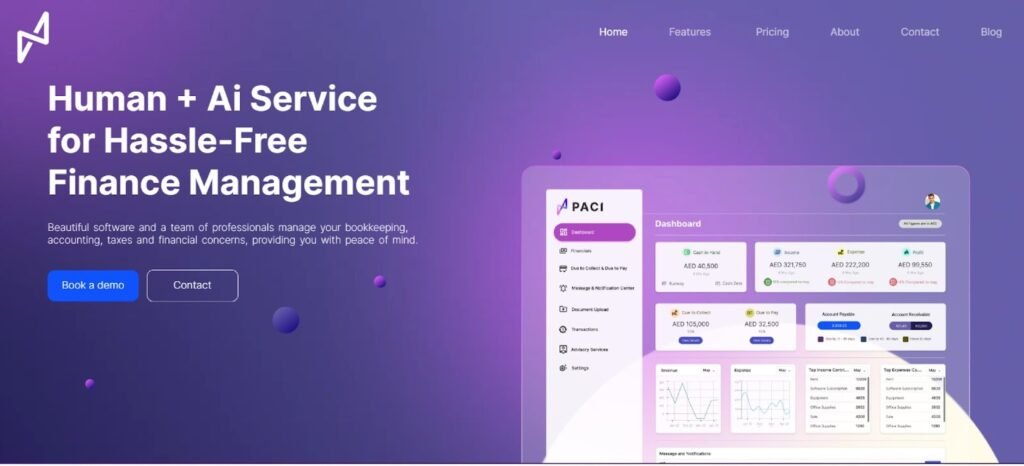

How Paci.ai Can Help in Corporate Tax Rules?

For companies operating in the region, the new corporate tax laws in Dubai for 2024 bring both opportunities and challenges. It takes a careful understanding of the tax law as well as a calculated approach to compliance and optimization to navigate these changes. Here, Paci.ai‘s ability to collaborate and offer services can be extremely valuable.

1. Simplifying Tax Compliance

- Automated Tax Calculations: Paci.ai’s platform can calculate your corporate tax obligations automatically based on the new regulations, guaranteeing accuracy and sparing you time.

- Streamlined Tax Registration: Paci.ai can assist you with the corporate tax registration procedure, making sure your company complies with all applicable legal and regulatory criteria.

- Efficient Tax Filing: The platform can assist you in monitoring tax filing deadlines, guaranteeing that your company files its taxes on time and stays out of trouble.

2. Strategic Tax Planning

- Tax Optimization: To assist you reduce your tax obligations, Paci.ai’s team of tax professionals can advise you on tax-efficient techniques that are suited to Dubai’s new corporate tax system.

- Financial Forecasting: You can use the platform’s financial forecasting capabilities to determine how the new corporate tax laws will affect your future cash flow and profitability, which will help you make well-informed strategic decisions.

3. Navigating Taxation for Foreigners

- Expatriate Tax Advisory: Paci.ai can offer advice to companies with foreign investors or staff members regarding how the new corporate tax laws will affect their tax status in Dubai.

4. Leveraging UAE Corporate Tax-Free Zones

- Free Zone Compliance: Paci.ai can assist companies who operate in the free zones of the UAE in navigating the particular tax laws that apply to them in light of the new restrictions, allowing them to maintain their tax exemptions while still complying with the law.

Summing Up

Dubai’s upcoming corporate tax laws are set to make 2024 a pivotal year for businesses in this dynamic city. These changes will transform how companies operate financially, affecting businesses big and small. The new rules include a 9% corporate tax on profits above AED 375,000, along with some special exceptions to encourage growth and innovation.

As these changes roll out, businesses must stay ahead by being informed and ready for tax planning and compliance. Therefore, companies must choose the right platform to have more comprehensive knowledge of corporate tax rules and how they impact the business.

Get in touch with us right now to find out more about how we can give you confidence in a tax landscape that is constantly evolving.