Accurate and smart money management is beneficial in today’s challenging corporate environment and essential to long-term viability and expansion. However, without organized procedures, managing complex financial management issues may drive companies into trouble.

Before the wide acceptance of corporate accounting, businesses frequently struggled with disorganized financial data, incorrect profitability metrics, and regulatory issues that limited their ability to expand and run efficiently.

Enter corporate accounting, a light of hope in the confusing financial landscape. This methodical approach gives firms the analytical tools they need to make well-informed decisions, while also streamlining financial reporting and regulation.

According to a report, 62% of business owners believe accountants go to their maximum extent to minimize tax implications. Corporate accounting lies at the center of it all. To help businesses manage vast financial landscapes, make more informed choices, and maintain legal compliance, the accounting team undertakes this essential role of corporate accounting.

Because it is essential to the proper operation of business finances, understanding corporate accounting and its role in supporting business growth is vital. So, let’s look into the key roles of corporate accounting in business.

Role of Corporate Accounting in a Business

Let’s have a clear understanding of the key role of corporate accounting in a business.

1. Planning and Controlling Financial Policy

Accounting experts create and implement the financial policies that direct resource allocation, budgeting, and financial decision-making. They are also essential in regulating and overseeing these policies to guarantee that the company stays within its budgetary restrictions and that its financial goals are fulfilled. This role minimizes risks and maximizes resource use to assist firms in achieving financial stability, growth, and sustainability.

One of the roles of a corporate accountant is to support the company’s decision-making process. The ability to analyze data is necessary if they are to use tools such as ROI (return on investment) and cost-benefit analysis to determine the company’s financial health. They have to also look at the business’s prior records and assist with the required financial analysis.

2. Preparing Budget

The budget of the business must be created and maintained by the accountant. To precisely predict the company’s upcoming success, they also need to examine the trends from the prior year. Managers can use this data to make cash flow estimates, sales plans, and budgets for overhead expenses. Next, they must update the regular accounting reports to ensure that expenses don’t exceed the allocated funds.

3. Monitoring Financial Transactions

Accurate recording of all financial transactions is ensured by accounting. Thus, it results in easy transaction management. This involves keeping track of your earnings, outlays, possessions, and debts. Reliable financial documentation is necessary to make well-informed business decisions.

4. Auditing Finances

Accounting is regarded as a fundamental task performed by every business. It assists in gathering numerous financial data points that are useful for carrying out additional tasks like auditing and tax filing, among other things. Such other functions cannot be carried out at all if the accounting function is not carried out correctly.

The accountant needs to get ready for both internal and external audits of the company. The regulatory bodies carry out the external audits, and management handles the internal audits. The accountant is responsible for verifying that all of the enterprise’s financial documents and reports are accurate, reliable, and free of any significant errors.

5. Ensuring Vigilance Against Fraud

Accounting ensures that corporate funds are not misappropriated or misused. They use cybersecurity, in particular, to guard the company’s assets from fraud, both external and internal. To safeguard the company’s assets, an accountant may choose to work with an outside organization or focus on protecting digital financial data.

For the purpose of preventing theft and deception, they set up an internal control system in the business. The purpose of corporate accountants is to guarantee that all financial records are genuine and that businesses are not mismanaged.

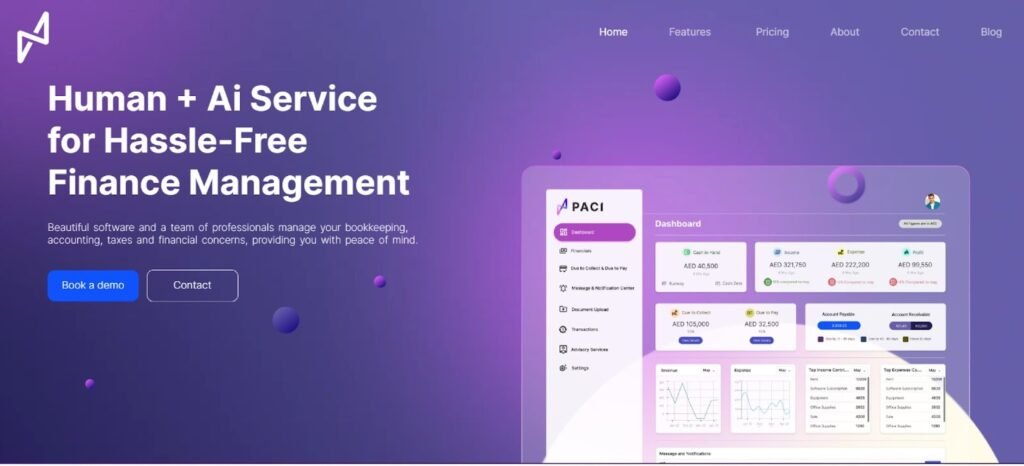

How Paci.ai Helps in Accounting

In short, Paci.ai revolutionizes the field of accounting by offering a simplified and efficient solution that eliminates the complexities and challenges associated with financial management. With Paci.ai, businesses can streamline their accounting procedures and ensure a seamless financial experience.

Further, we help streamline and simplify your financial procedures through our customized insights and financial advisory. Your simple financial experience is ensured by the combination of an intuitive interface and a human + AI platform. Give your details to Paci.ai so you can concentrate on what you do best—expanding your company.

Paci.ai helps in:

- Automated Bookkeeping

- Real-Time Financial Insights

- Tax Compliance

- Document Management

- Professional Advice

Conclusion

Accounting is a complex field with many applications in the business world. First and foremost, accounting provides precise financial data and performance measures, which form the cornerstone of informed choices. It helps businesses to effectively schedule, manage assets, and pinpoint areas in need of development.

Accurate financial records are an essential tool for Paci.ai to draw investors and keep their trust. Stakeholders trust businesses when financial data is trustworthy and transparent. Furthermore, accounting contributes to the security and viability of the business by identifying irregularities and possible fraud, which helps with risk management.

So, why are you looking for multiple choices to choose from?

Let’s connect to gain more knowledge on financial management and corporate accounting.