Are you a freelancer in the UAE, navigating the complex realms of financial management? You’re not alone. Freelancers like you often grapple with unique challenges when handling their finances. Whether it’s managing income, tracking expenses, or tax obligations, the freelancing world can be a maze.

One of the critical decisions freelancers face is whether they need a business account in the UAE. This question is at the heart of every freelancer’s financial journey in this dynamic market.

So, if you’re seeking clarity on business accounts for freelancers in UAE and looking for an efficient way to manage your finances, you’re in the right place. As an integrated finance management platform, we help you get the right insights and clear your worries.

Let’s embark on this journey together, addressing your concerns and providing valuable insights.

Understanding Freelancing in the UAE

Once seen as an unusual job choice, freelancing or digital nomads have become increasingly common worldwide. Professionals are increasingly selecting it because of the flexibility and freedom it provides. Freelancers work on a whole-project basis to deliver services to businesses or clients. Thanks to this configuration, they may choose their hours, be flexible with their profession, and work from home.

(UAE) is become the global epicenter for digital nomads. Owing to its strategic location, vibrant economy, and diverse culture, the United Arab Emirates has become a sought-after destination for professionals seeking freelance work. Even the government has recognised this with the rule of Dubai announcing 150 Million fund for content creators

The UAE provides a vibrant atmosphere for freelancers to flourish, regardless of their profession: writer, designer, developer, marketing, or consultant.

Business Account Types in the UAE

One of the first choices you’ll have to make when handling your money as a freelancer in the UAE is whether to set up a business account. A business account is a bank account specifically made to accommodate freelancers’ and other entrepreneurs’ financial needs.

However, it’s essential to know the many kinds of business bank accounts offered in the UAE and pick the one that best meets your needs before hastily opening one.

Personal vs. Business Accounts: What’s the Difference?

Let’s first explain the differences between personal and business accounts before getting into the details of each.

- For our daily financial operations, most of us utilize a personal account. It’s where you are paid, handle your savings, and make bill payments.

- On the other hand, a business account is designed to meet the particular needs of managing a firm, even if it is a freelancer.

The following are some significant differences:

- Account Name

Business accounts are registered under your business name. This is sometimes called a trade name or a business trade license. Personal accounts are usually registered in your name.

- Transactions

Business bank accounts are ideal for managing spending, collecting payments from customers, and keeping accurate financial records since they are made to handle a more significant amount of transactions.

- Professionalism

Maintaining a business account helps you project a more polished appearance. It keeps your business and personal funds apart, which is helpful when interacting with clients and tax officials.

Benefits of Having a Business Bank Account for Freelancers

After explaining what a business account is and why it’s critical to keep personal and business bank accounts separate, let’s explore the various benefits that freelancers in the UAE can enjoy from having a business account.

1. Professionalism and Credibility

In the freelance industry, in particular, first impressions are crucial. Having a distinct business account conveys professionalism and authority to potential clients. It demonstrates your commitment to both financial transparency and quality of work.

2. Segregation of Money

It can be challenging to keep track of revenue, expenses, and tax responsibilities when personal and business money are combined. Having everything organized into separate categories in a business account makes managing your finances more manageable.

3. Simpler Tax Compliance

In the UAE, freelancers are expected to keep correct bookkeeping and pay taxes by the law. A business account simplifies this procedure by giving you a comprehensive record of all the transactions connected to your firm and makes tax compliance much easier to handle.

4. Improved Financial Tracking

With a business account, handling your freelance finances is simple. You can quickly manage spending, keep an eye on your income, and create financial reports that will give you important information about your company’s financial health.

5. Access to Credit and Firm Loans

As your business grows and expands, you could require credit lines or business loans as a funding source. If you have a specific business account, which proves the track record of your company’s finances, banks are more likely to consider your application.

6. Customer Trust

When working with freelancers, clients who uphold a clear financial process tend to favor them. Your clients’ trust might increase by having a business account because it makes it simple to check payments and transactions about their projects.

7. Security

Sophisticated safety features are often available in business accounts, shielding your money and financial data from prospective attackers. You and your clients can feel more at ease with this extra security.

To highlight the advantages even further, let’s examine the following statistics:

- A FreshBooks survey pointed out that Freelancers who utilize a business bank account have a three times higher chance of meeting their income targets than those who don’t.

- According to an Intuit QuickBooks survey, 64% of freelancers feel more financially stable when they use a business account because they feel more in charge of their money.

- Based on a Fundera survey, 75% of freelancers said that having a company account and keeping personal and business money separate improved their work-life balance.

These figures highlight the useful benefits of having a business account designed explicitly for your freelancing activities. It’s essential to prepare oneself for financial success rather than focusing only on compliance.

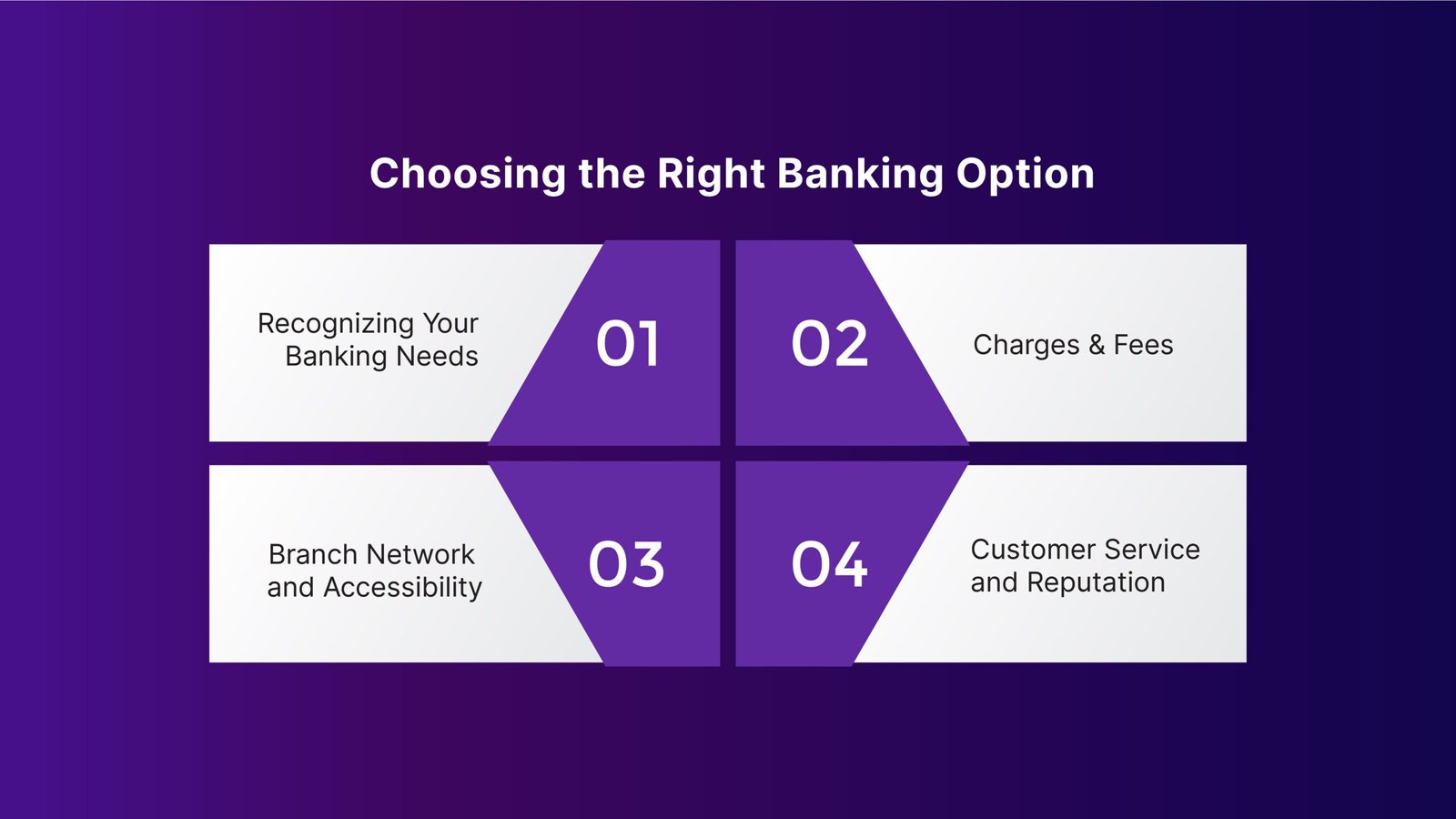

Choosing the Right Banking Option

After delving into whether freelancers in the UAE require a business account, let’s move on to the useful part of the process: selecting the best banking solution. It’s important to consider your options carefully because this choice will greatly impact your overall experience and freelance financial management.

1. Recognizing Your Banking Needs

Comprehending your unique requirements as a freelancer is the first step toward choosing the finest banking solution. Here are some things to think about:

- Transaction Volume

- Account Type

- Online Banking

2. Charges & Fees

It’s critical to understand the fees associated with banking services. Monthly maintenance costs, transaction fees, and ATM withdrawal fees are examples of common fees. Examine the charge schedules of several banks carefully to select one that fits your spending plan and usage habits.

3. Branch Network and Accessibility

Take into consideration the bank’s actual location. Select a bank with a branch network that works for your location or company needs if you prefer in-person banking or anticipate needing to visit a branch.

4. Customer Service and Reputation

Credibility is important. Choose a bank with a reputation for dependability, warmth, and responsiveness. Look for recommendations, read reviews, and gauge how quickly they respond to your questions.

Simplifying it, the best banking choice for your freelancing business should be determined by your needs and preferences. Spend time investigating and contrasting possibilities, considering costs, accessibility, and reputation.

For example, freelancers can start their accounts in banks such as Wio, Mashreq Neo, and so on in the UAE.

Mashreq Neo serves as a bank in the bright new world. It’s a mobile-only digital bank that runs solely on Mashreq! In addition to checking balances, statements, and transaction histories, you may also trade stocks, make payments, send and receive money locally and internationally, and start an account quickly.

On the other side, Wio is an intelligent financial platform that links you to the future with a suitable network, services, and assistance to improve your life.

Role of Paci.ai in Managing Freelance Finance Operations

Consider that Paci.ai is here to assist you on your hassle-free financial management journey, offering you the tools and peace of mind to succeed as a freelancer in the UAE.

We at Paci.ai recognize how important it is for freelancers operating in the UAE to select the appropriate banking option. As a result, we’ve skillfully incorporated financial management into our services.

The major features of Paci.ai software include

- Real-Time Financial Insights Dashboard

- Tailored Bookkeeping & Tax Suite

- Seamless Receivable and Payment Management

- Real-Time Communication Channels

- Customized insights & Financial advisory

- Easy Transaction Management

Conclusion

Making well-informed decisions on your financial future is crucial in today’s fast-paced world. We invite you to integrate with Paci.ai as your go-to resource for streamlined financial management. Our integrated finance management platform is made to assist freelancers like you by providing the resources and knowledge required to succeed in the always-changing field of freelancing

Remember that having the appropriate resources at your disposal can make all the difference in your freelancing work, as financial security is crucial.

Connect with us for more information on how finance can be managed by freelancers like you without any worries.