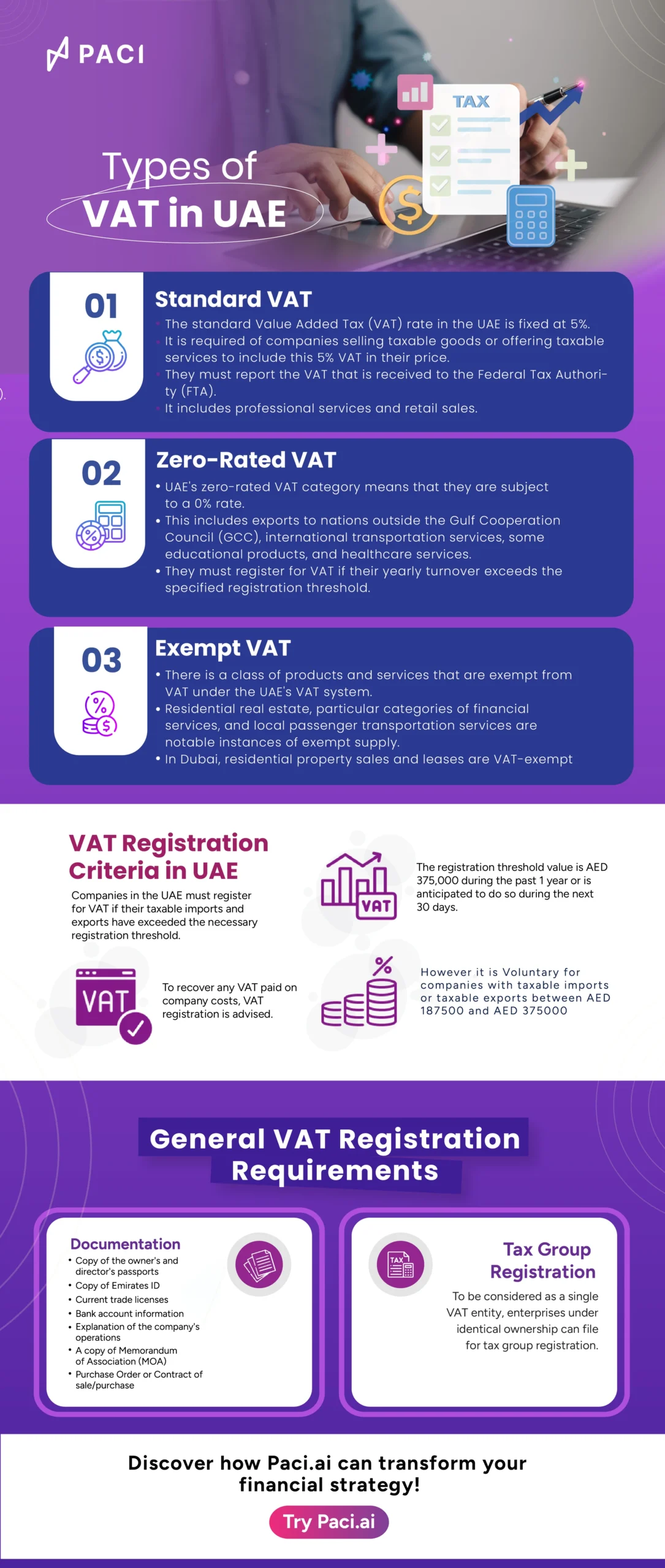

Types of VAT and VAT Registration Criteria for Different Business Types

Introduction

With the introduction of VAT in 2018, there was a dramatic change that required firms to navigate unfamiliar financial circumstances.

The path is challenging, as various companies have distinct difficulties in understanding VAT differences.

Knowing VAT registration criteria is essential for businesses hoping to succeed in the fast-paced business environment of the UAE.

Thus, it is essential that businesses have the right integrated platform for financial management.

So, let’s delve into the types of VAT and VAT registration criteria for different business types

How Paci.ai Can Help Finance Management

Let’s see how Paci.ai can be the best platform for you as you navigate the VAT environment.

- Easy Finance Management

- Automated Bookkeeping

- Real-Time Financial Insights:

- Tax Compliance Simplified

- Simplifying VAT Registration and Compliance

- Easy VAT Registration

- Simple VAT Refunds

- Proactive VAT Threshold Monitoring

- Customized Approaches for Various Business Types

Conclusion

Every company needs to carefully and precisely traverse the VAT registration criteria.

We are one of the best integrated finance management platforms for you on your path, for hassle-free financial management.

Our devoted team of experts and services are focused on streamlining VAT registration and compliance so you can relax and concentrate on what you do best—managing your business.